We use cookies to give you the best digital experience. By continuing to browse this site, you give consent for cookies to be used. To learn more information about the use of cookies, please visit our cookie policy.

iSuite Insight Issue #21: China’s Booming Collectible Toy Market 2025

China’s collectible toy market is experiencing unprecedented growth, driven by rising consumer enthusiasm for intellectual property (IP) characters and the thriving “kidult” culture. Unlike traditional toy categories, collectible toys appeal not only to children but also to Gen Z and millennial Chinese consumers, who seek self-expression, identity, and emotional comfort through their purchases. This expanding market highlights the evolving definition of toys in modern China, from playthings for children to lifestyle companions for all ages.

This article explores the remarkable rise of the collectible toy market in China and shares exclusive insights from iFans on Xiaohongshu consumer behaviors. From popular IPs like Labubu and Chiikawa to the emotional drivers behind social conversations, how brands can tap into this fast-growing sector is uncovered.

Overview of China’s Collectible Toy Market

Key Market Statistics

Collectible toys are outperforming within the broad China’s toy market. Daxue Consulting estimates that China’s collectible toy segment will surpass US $21.5 billion by 2025, growing at an annual rate of 35%1, while report from Grand View Research also projects the collectibles market in China to reach US $34.1 billion by 2030, at a CAGR of 6.7%2.

At the industry level, Pop Mart serves as the most striking case study. Best known for its Labubu and Crybaby figures, the company revenue surges 204% and its net profit increase of nearly 400% in the first half of 20253, largely fueled by demand for IP-based collectibles. Labubu alone generated nearly US $670 million in sales3. Its blind-box model, rapid international expansion, and IP licensing deals underscore the sector’s enormous commercial potential.

Propelled by IP storytelling, social sharing, and emotional resonance, the collectible toy market is a premium growth engine within the China toys market, signaling great potentials in the market.

Insights from iSuite: Understanding the China Collectible Toy Market Consumers

Audience Demographic

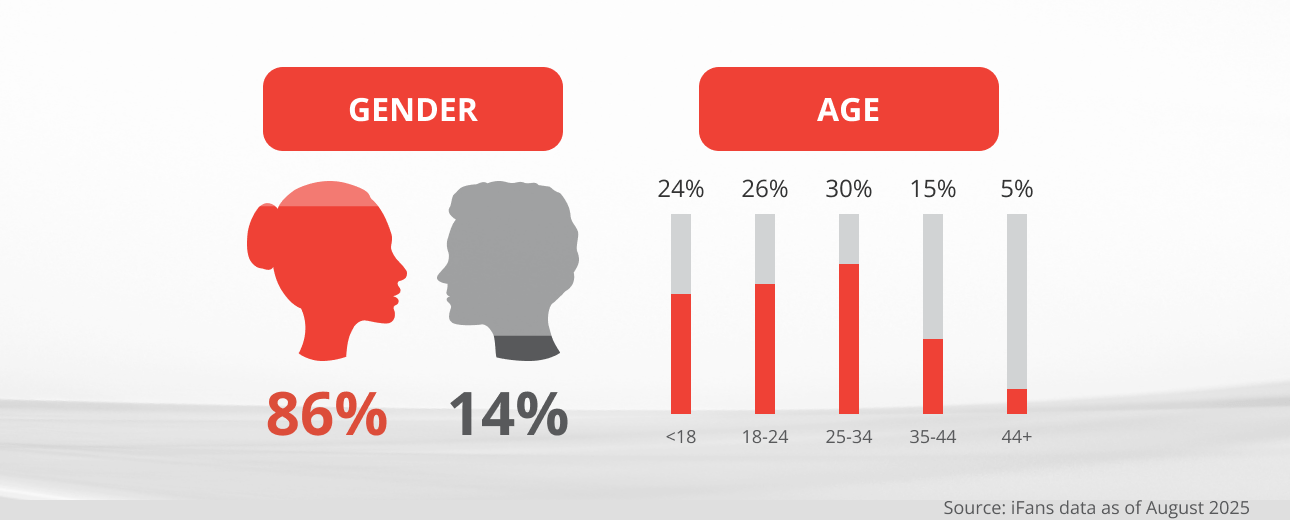

Xiaohongshu users who actively follow toy-related topics have the following characteristics.

- Gender: 14% Male: 86% Female

- Age group:

- <18: 23.5%

- 18-24: 26.0%

- 25-34: 30.6%

- 35-44: 14.6%

- >44: 5.3%

Data from iFans reveals that Xiaohongshu users engaging with collectible toy content are overwhelmingly female, accounting for 86% of the audience. Age distribution is youth-centric, with 23.5% under 18, 26% between 18–24, and 30.6% between 25–34. This means nearly 80% of the community is under 35, underscoring the role of Gen Z and Gen Alpha Chinese consumers and young millennials in driving the trend.

The demographic profile reveals that young women are at the core of China’s collectible toy market, driven by nostalgia, aesthetics, and the desire for social expression. Beyond purchasing for personal enjoyment, this group actively participates in online communities, sharing collections and discussing new releases as part of their lifestyle. Many also enjoy spending time to assemble, display, or interact with their toys, transforming collectibles into a bridge between leisure, creativity, and emotional satisfaction. In this way, collectibles are embraced as lifestyle companions rather than simple toys.

Trending Topics on Xiaohongshu

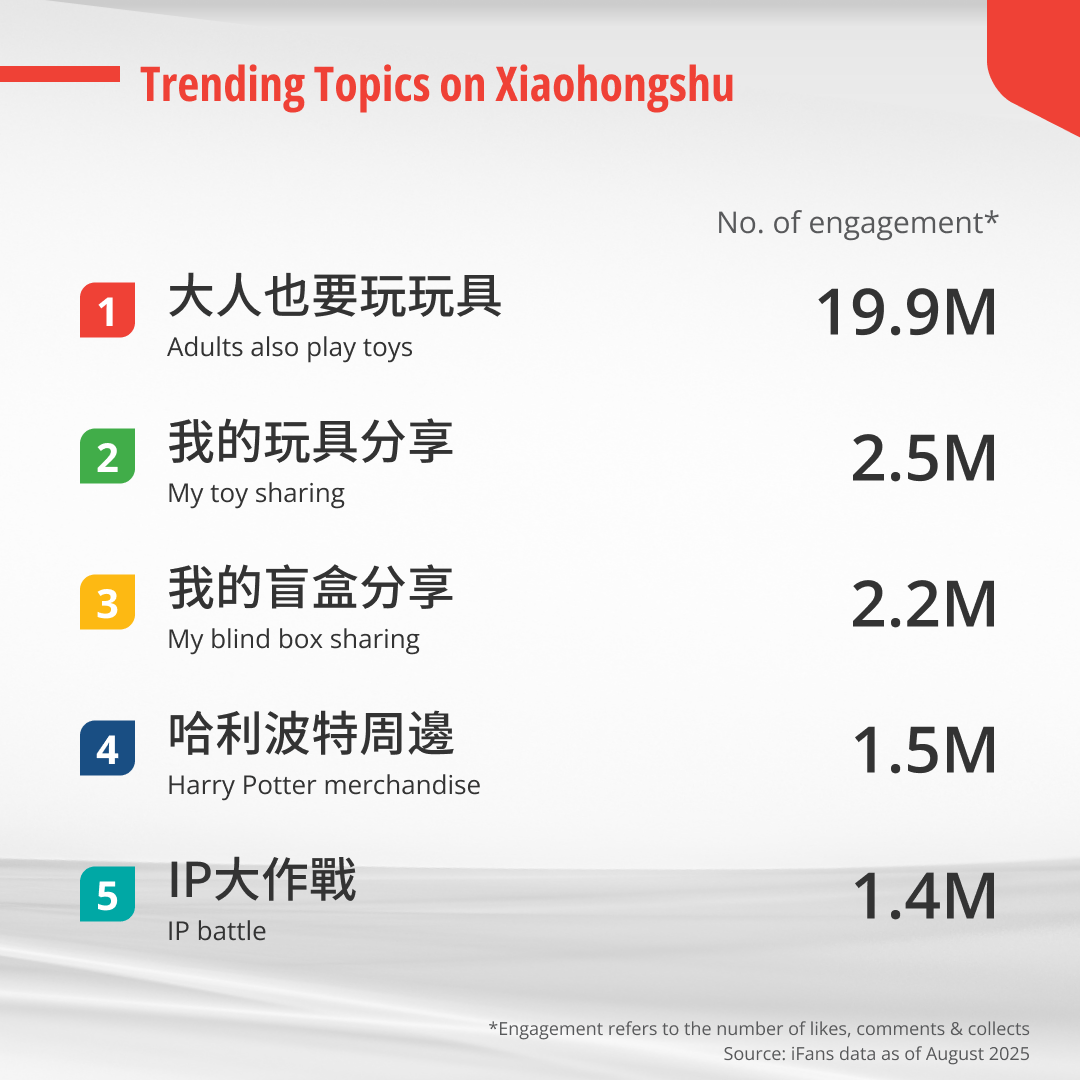

Analysis of Xiaohongshu hashtags highlights consumer passion for collectible toys. Leading keywords include:

- #大人也要玩玩具 (Adults also play toys)

- #我的玩具分享 (My toy sharing)

- #我的盲盒分享 (My blind box sharing)

- #哈利波特周邊 (Harry Potter merchandise)

- #IP大作戰 (IP battle)

The dominance of “Adults also play toys” demonstrates the trend of “Kidult” has sweep across China. Collectibles are no longer restricted to children. Meanwhile, the prevalence of “My toy sharing” and “My blind box sharing” reflects Xiaohongshu’s role as a platform for product discovery and validation. Sharing genuine reviews on purchases has become an active behavior, fueling organic virality and consumer desire.

Engagement refers to the number of likes, comments & collects

Top 5 Most Popular Collectible Toy IPs

The top IPs by engagement on Xiaohongshu are as follow:

- Harry Potter

- Sanrio

- Labubu

- Chiikawa

- Disney

Unlike other toy categories where domestic brands have a significant presence, collectible toys thrive on globally recognizable IPs that resonate across cultures. From Harry Potter and Disney’s enduring fantasy appeal to Sanrio’s kawaii characters, from Labubu’s playful blindbox to Chiikawa’s storytelling, these IPs succeed by blending international recognition with Chinese consumer sensibilities.

Brand Performance and Consumer Preferences on Collectible Toy Products

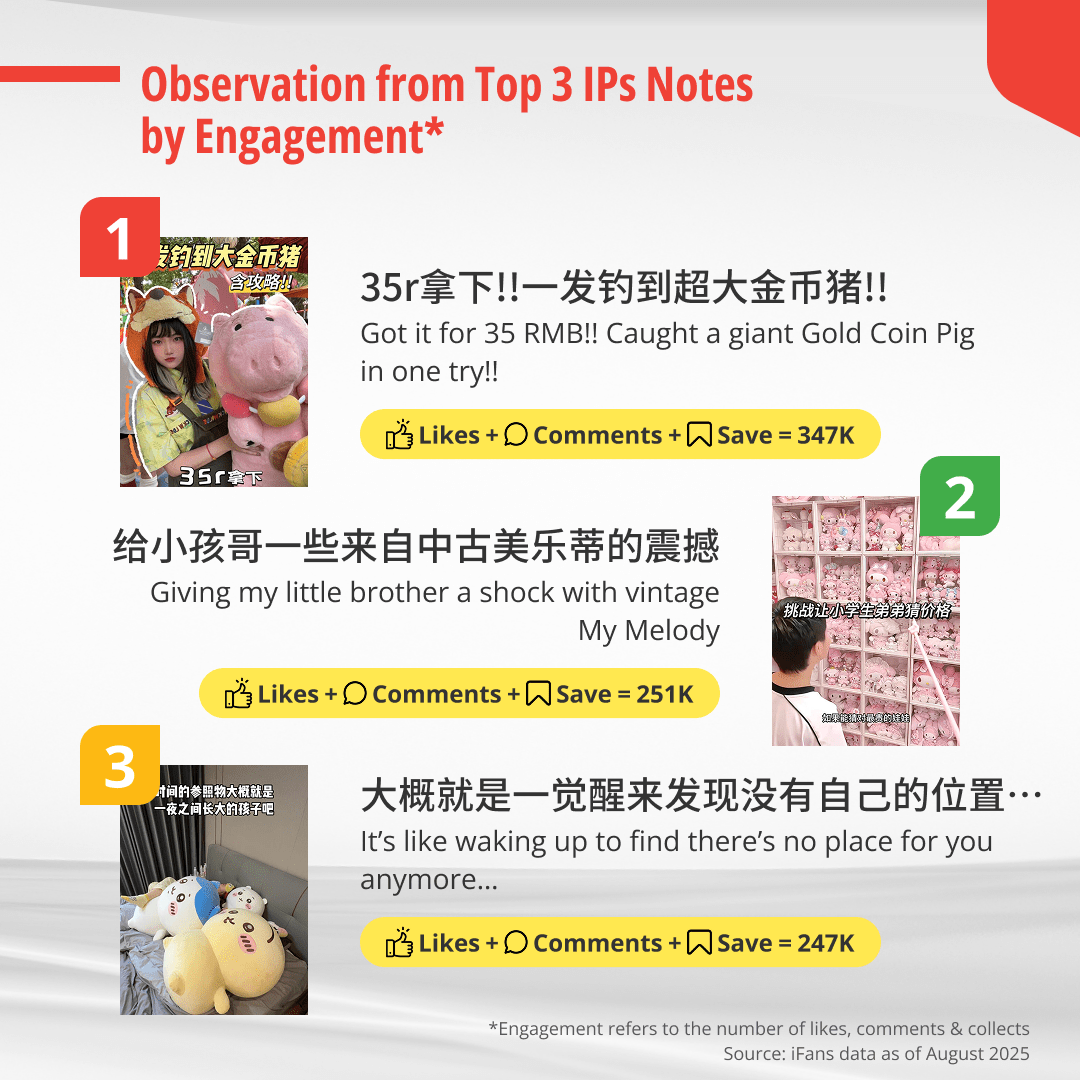

Observations from the Top 3 IPs by Notes’ Engagement

Analysis of high-engagement Xiaohongshu notes shows that virality often stems from two main content strategies:

- Novelty and Gamification: Exemplified by the Disney Gold Coin Pig game, where users shared tips on “catching” a toy pig at Disneyland for RMB 35. The blend of affordability, playfulness, and Disney’s strong IP appeal created excitement and relatability.

- Visual Impact: Seen in Sanrio Melody collection wall and Chiikawa’s “growing up” narrative, both posts relied on eye-catching visuals to spark humor, surprise, and user-generated participation.

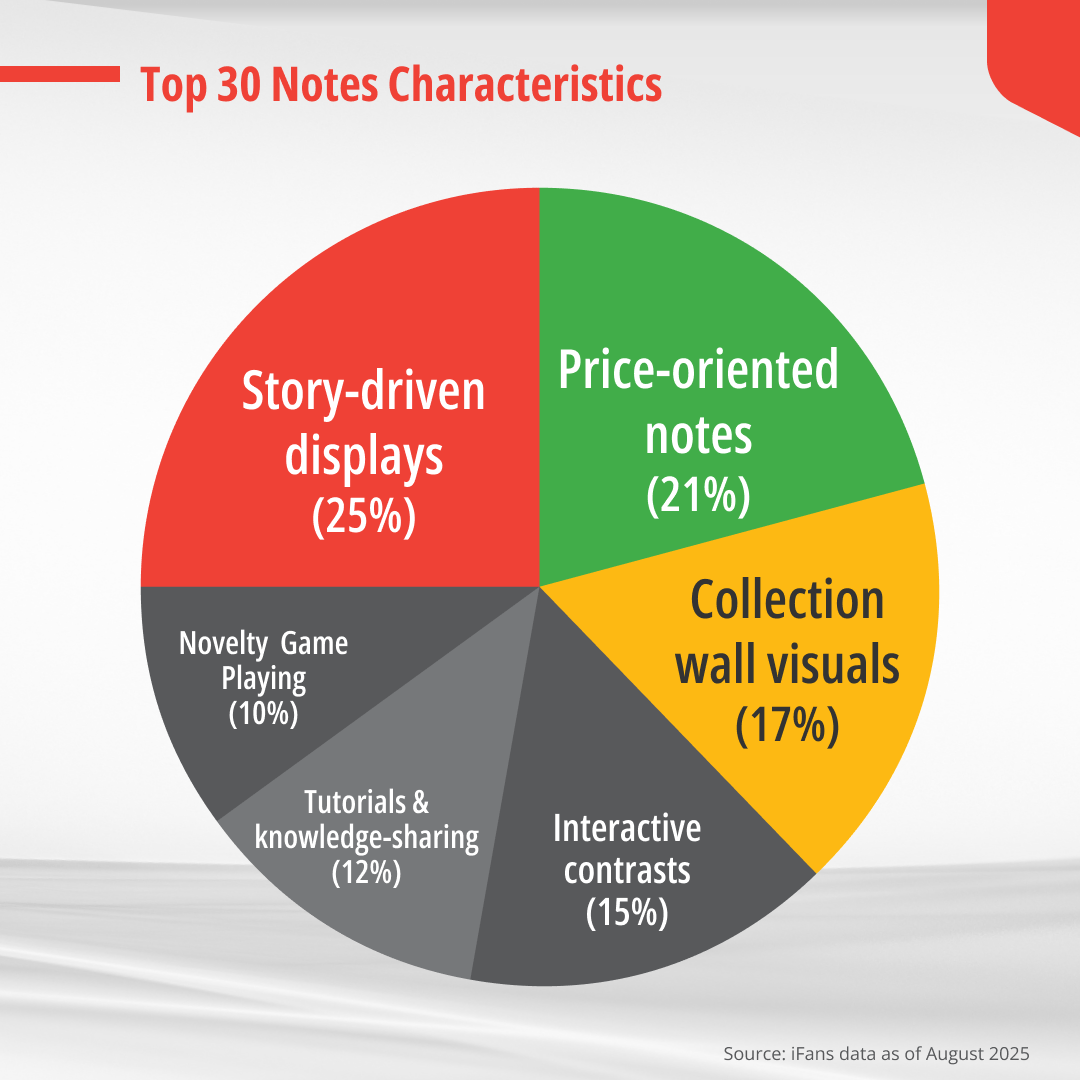

Top 30 Notes Characteristics

Looking more broadly at the top 30 notes by engagement, three content types stand out:

- Story-driven displays (25%): Consumers enjoy immersive narratives that transform toys into characters and experiences, making collections feel alive and share-worthy.

- Price-oriented notes (21%): Posts that highlight affordability or cost-value comparisons resonate strongly, reflecting consumers’ curiosity about how to access popular collectibles without overspending.

- Collection wall visuals (17%): Striking visual displays of large collections capture attention and signal both dedication and exclusivity, tapping into consumers’ admiration for scarcity and status.

These top three categories reveal that narrative, price and visual spectacle are the most effective ways to drive engagement and turn collectibles into conversions on Xiaohongshu, highlighting the need for brands to design content that is both entertaining and informative.

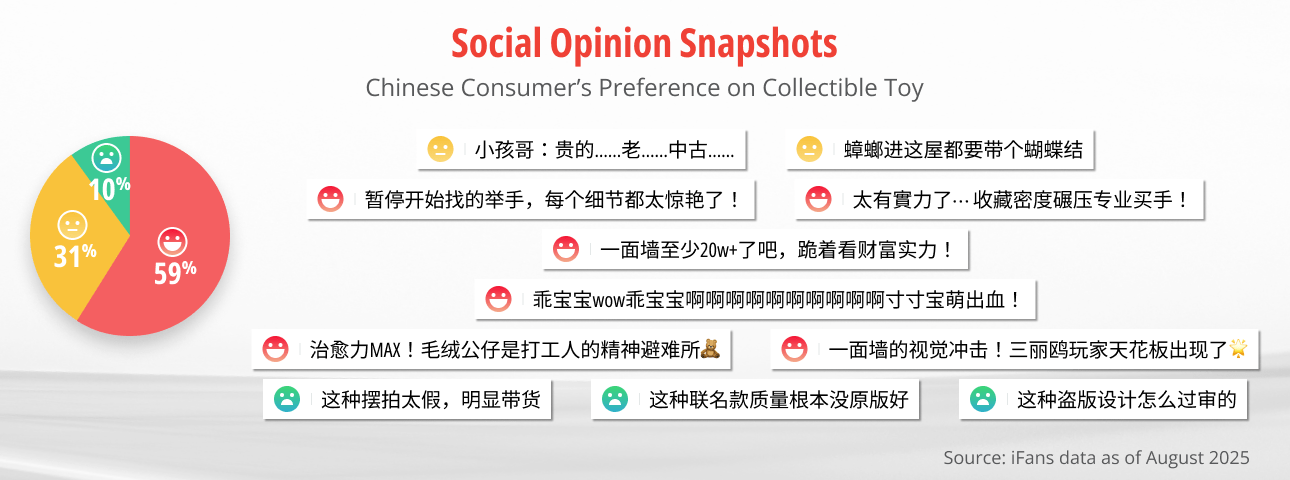

Social Opinion Snapshots

Consumer sentiment around collectible toys on Xiaohongshu is largely positive:

- 59% Positive: Centered on IP value recognition and emotional resonance, with users praising collections as “healing” or valuing their cultural significance.

- 31% Neutral: Featuring lighthearted humor, playful commentary, or practical price and quality inquiries.

- 10% Negative: Focused on skepticism around over-commercialization or concerns about product quality in limited editions.

Overall, sentiment indicates that collectible toys are embraced as lifestyle and emotional companions, not just products. However, brands should concern about authenticity and product standards to avoid alienating fans who are sensitive to issues of quality.

Key Takeaways on China’s Collectible Toy Market

Summary:

- Heightening Popularity: Collectible toys are growing faster than the overall China toys market, with a CAGR of 35%, driven by strong demand and a rising “kidult” culture

- Gen Z and Millennials Female Consumers Lead: Women under 35 dominate demand, “Kidult” are showing a strong desire to share their purchases on Xiaohongshu.

- Content Formula Works: Notes with visual impact, emotional connection and shareability fuel engagement. Infusing this formula can guide brand storytelling strategies.

Conclusion:

China’s collectible toy market is evolving into a powerful cultural and commercial phenomenon with strong growth projections. With an enthusiastic young consumer base and the influence of Xiaohongshu in shaping purchase decisions, the sector offers immense opportunities for marketers to capture the hearts of Chinese consumers by leveraging emotional storytelling and social engagement in this vibrant market.

Source:

1: https://daxueconsulting.com/china-collectible-toys-market/

2: https://www.grandviewresearch.com/horizon/outlook/collectibles-market/china

3: https://www.reuters.com/world/china/chinas-pop-mart-maker-labubu-doll-says-profit-soars-nearly-400-first-half-2025-08-19/

Explore More iSuite Research

- Unlocking China's Booming Health Supplement Market — Trends and Strategies for 2025

Unlock the potential of China’s health supplement market in 2025. Discover consumer trends, Xiaohongshu strategies, and tips for engaging Chinese audiences with vitamins, TCM herbs, and beauty supplements. - The Resilience of China’s Luxury Jewelry Market in 2025

Discover how Gen Z preferences, online trends, and cultural nuances are shaping China's luxury jewelry market and its future growth, and how your brand can capitalize. - China’s Evolving Perfume Market Landscape

Explore the burgeoning perfume market in China and how to leverage the influence of social media to effectively resonate with Chinese consumers in the promising market.

More Insights

Double 11 Shopping Festival 2025: The Craze Continues with Simplified Discounts

October 27, 2025

Explore iFans insights for Double 11 Shopping Festival 2025. Discover how simplified promotions and China social media trends are reshaping the China eCommerce landscape.

Unboxing China’s Digital Trends: Xiaohongshu Leads the Double 11 Gadget Boom

October 21, 2025

Explore China Digital Trends during Double 11 on Xiaohongshu. Discover how digital gadget brands can tap native content and data-led strategies to boost sales together with iClick Interactive.

Douyin Unlocks Fall 2025 China Fashion Trends: Seasonal Insights to Win Double 11

October 15, 2025

Discover China fashion trends this fall on Douyin. Explore top style insights and learn how iClick helps brands win seasonal audiences and maximize sales during Double 11.

KOL是什麼?和網紅差在哪?一次帶你搞懂KOL行銷優勢!

October 9, 2025

KOL是什麼意思?KOL和網紅的分別是什麼?本篇文章說明KOL的定義、優勢及其和網紅有哪些差異,並分享4個挑選合作KOL的原則,文末再推薦專業的小紅書跨境營銷代理商,幫你快速媒合KOL人選!

小紅書推廣全攻略|學會這些小紅書營銷秘訣,超高流量不是夢!

October 9, 2025

想用小紅書營銷打入年輕市場嗎?本文將介紹6大小紅書經營策略,教你怎麼利用小紅書宣傳自己的品牌,並解析廣告投放、網紅合作等宣傳方式,最後分享優質的一站式小紅書推廣服務廠商給你!

Xiaohongshu (Little Red Book) Marketing: Complete Guide

October 8, 2025

Learn how to market on Xiaohongshu, China’s rising social commerce platform. Connect with Chinese consumers, build trust, and grow your brand effectively.

Travel Retail Marketing: Winning Strategies for Chinese Consumers

October 8, 2025

Unlock growth with smart travel retail marketing. See how to attract Chinese travelers using data-driven insights and digital tools to drive sales and loyalty.

Kid Skincare in China: Trends and Strategies for a Growing Market

September 23, 2025

Discover the growing demand for kid skincare in the China Skincare Market. Learn about key trends and data-driven marketing strategy to engage parents in this rising segment with iClick.

China Social Media 2025: Top 10 Platforms & Marketing Insights

September 11, 2025

Unlock secrets of the most popular social media platforms in China’s digital landscape. Learn how brands can reach, engage, and grow in the Chinese market.