We use cookies to give you the best digital experience. By continuing to browse this site, you give consent for cookies to be used. To learn more information about the use of cookies, please visit our cookie policy.

Double 11 Shopping Festival 2025: The Craze Continues with Simplified Discounts

The Double 11 Shopping Festival 2025 once again dominates China’s retail calendar. What began as a single-day event has evolved into a month-long shopping celebration, reflecting a shift in consumer behavior, marketing strategies, and brand engagement on Chinese social media.

This year, platforms are simplifying promotions, extending campaign durations, and prioritizing on sustainable growth rather than one-day sales spikes. For the Chinese luxury consumer, this transformation reflects an appetite for more transparent deals and thoughtful purchasing journeys that align with evolving lifestyle aspirations.

iFans Insights: What’s Trending on Xiaohongshu for Double 11?

According to iFans, iClick’s Xiaohongshu analytics platform, the Double 11 conversations are reaching unprecedented scale. In the past 30 days1:

#双十一 (Double 11) Hashtag Performance

- View: 12.03 billion

- Engagement: 2.55 million

While the spike is expected to fall on the second weekend of November, the current surge highlights the enduring hype of Double 11.

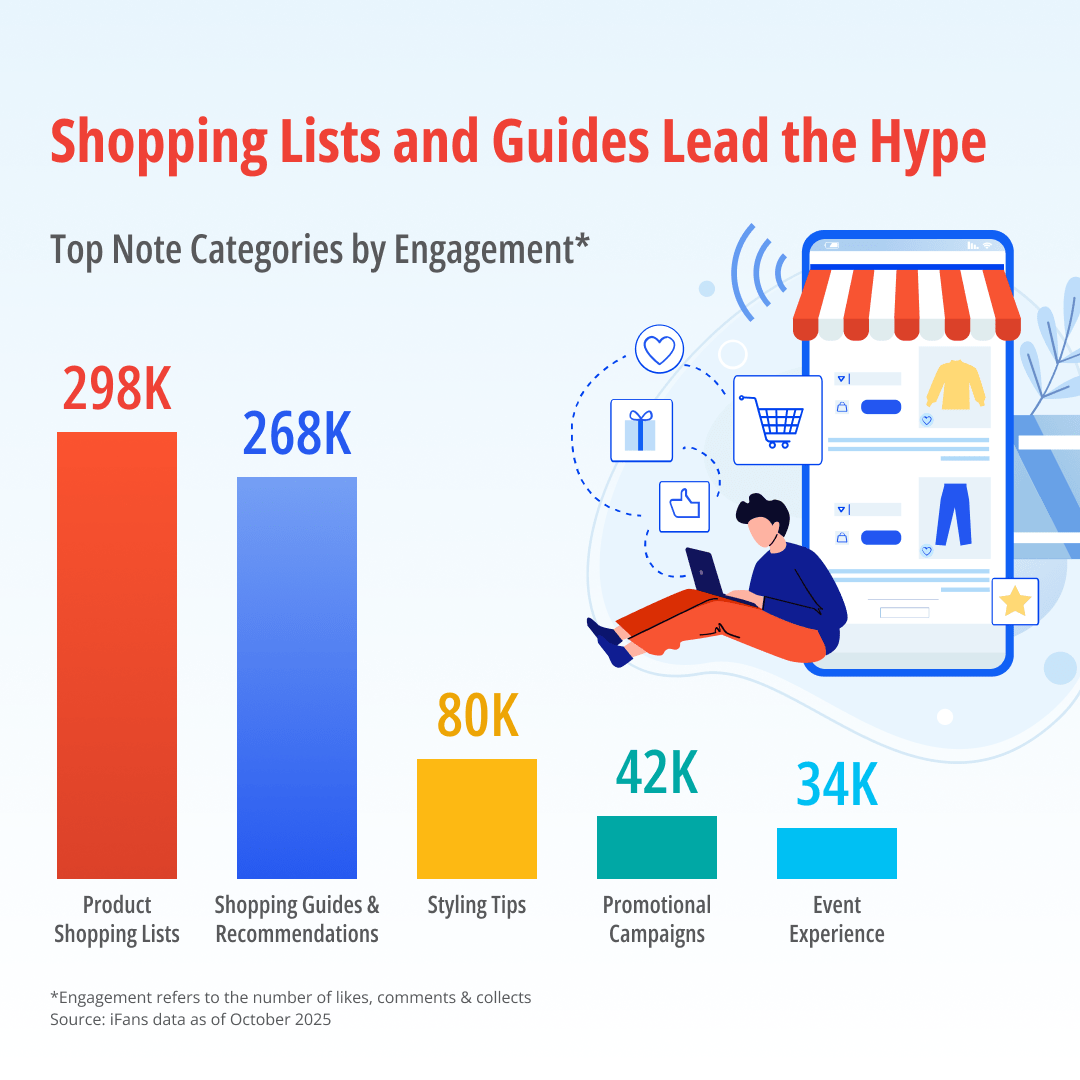

Top Note Categories Driving Engagement: Shopping Lists and Guides Lead the Hype

- Product Shopping Lists: 298K

- Shopping Guides & Recommendations: 268K

- Styling Tips: 80K

- Promotional Campaigns: 42K

- Event Experience: 34K

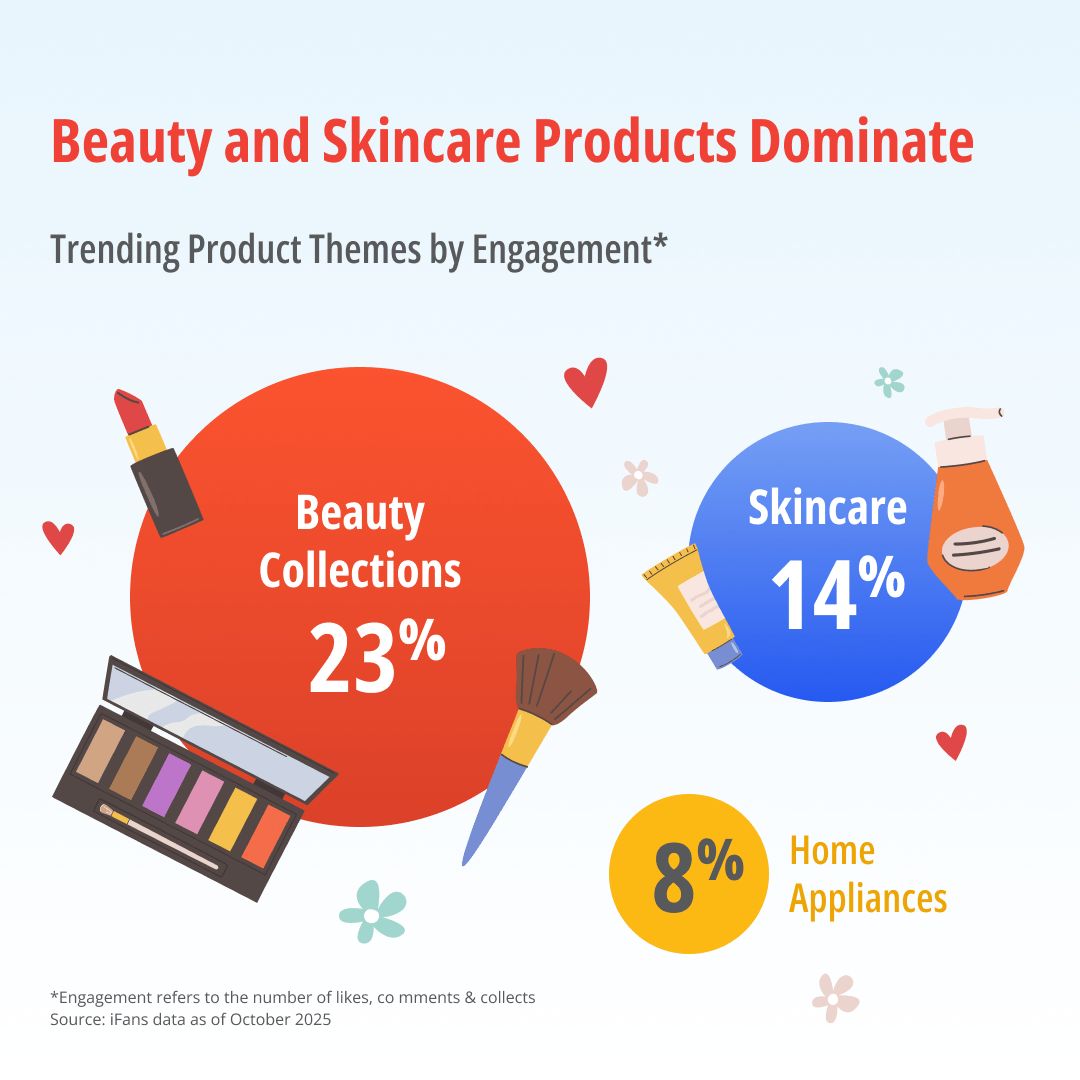

Trending Product Themes and Categories: Beauty and Skincare Products Dominate

- Beauty Collections: 23.17%

- Skincare: 13.7%

- Home Appliances: 7.59%

- Personal Care: 3.91%

- Overall Styling: 3.17%

- Others: 48.46%

For Double 11 2025, consumers are no longer rushing to make impulsive purchases on a single day. The extended campaign period is enabling more thorough, informed, and comprehensive shopping decisions, as users actively share shopping guides and product comparisons to maximize value and satisfaction.

Key Shifts in China Ecommerce: Simplified Discounts and Extended Campaigns

Simplified Discounts, Smarter Engagement

2025 marks a turning point in how platforms approach promotions. Following 618 Shopping Festival, Double 11 no longer relies on complex coupon stacking and inflated pricing. Today’s e-commerce giants are prioritizing clarity and convenience2:

- JD.com: “Official markdowns” as low as 10% of original prices, plus up to RMB 2,111 in extra vouchers.

- Douyin E-Commerce: “Instant discounts” of 15%+, supported by billion-level cashback campaigns.

- Taobao: Simplified “single-item markdowns” for easy, transparent shopping.

This shift not only reduces decision fatigue but also broadens Double 11’s appeal, particularly among mature and older consumers, while boosting retention rates and purchase efficiency.

Extended Campaigns: A Strategy for Steady, Season-Long Sales

Following China’s National Day Golden Week, most platforms launched their Double 11 promotions as early as mid-September, giving consumers more time to plan and shop.

This approach reflects a strategic industry shift—from short-term sales spikes to long-term engagement. This allows brands to plan more strategic product launches, optimize inventory management, and maintain steady momentum throughout the season. For consumers, it means more flexibility and time to explore genuine deals, reinforcing Double 11’s position as the ultimate shopping festival in China.

Partner with iClick to Elevate Your Double 11 Strategy

The Chinese luxury consumer today values authenticity, transparency, and relevance. To win their attention during this high-traffic season, brands must leverage real-time social data and content intelligence.

With iFans, iClick helps brands:

- Track trending hashtags, keywords, and influencer content

- Understand consumer sentiment and category momentum

- Optimize creative strategies for stronger engagement and conversions

Looking to make your brand part of the Double 11 conversation?

Sources:

1 iClick’s iFans platform, October 2025

2 https://mp.weixin.qq.com/s/fdt4E8P3PAixPx16Fsp5aQ

Related Insights: Explore More on China E-commerce Trends in 2025

- Douyin Unlocks Fall 2025 China Fashion Trends: Seasonal Insights to Win Double 11

Discover China fashion trends this fall on Douyin. Explore top style insights and learn how iClick helps brands win seasonal audiences and maximize sales during Double 11. - Unboxing China’s Digital Trends: Xiaohongshu Leads the Double 11 Gadget Boom

Explore China Digital Trends during Double 11 on Xiaohongshu. Discover how digital gadget brands can tap native content and data-led strategies to boost sales together with iClick Interactive. - iSuite Insight Issue #21: China’s Booming Collectible Toy Market 2025

China toys market is booming, with collectible toys driving growth. Discover Chinese toy trends on Xiaohongshu with iClick to gain valuable insights.

More Insights

China Study Abroad Trends on Douyin: Bridging Global Education with Outbound Travel Discovery

November 12, 2025

Discover how Douyin drives China study abroad trends, linking overseas education with outbound travel, cultural exploration, and global lifestyle insights.

Mapping China’s Financial Trends on Xiaohongshu: From Discovery to Decision

November 6, 2025

Explore how Xiaohongshu drives China financial trends with rising engagement in wealth management, investment, and financial education content, transforming discovery into decisions.

Unboxing China’s Digital Trends: Xiaohongshu Leads the Double 11 Gadget Boom

October 21, 2025

Explore China Digital Trends during Double 11 on Xiaohongshu. Discover how digital gadget brands can tap native content and data-led strategies to boost sales together with iClick Interactive.

Douyin Unlocks Fall 2025 China Fashion Trends: Seasonal Insights to Win Double 11

October 15, 2025

Discover China fashion trends this fall on Douyin. Explore top style insights and learn how iClick helps brands win seasonal audiences and maximize sales during Double 11.

KOL是什麼?和網紅差在哪?一次帶你搞懂KOL行銷優勢!

October 9, 2025

KOL是什麼意思?KOL和網紅的分別是什麼?本篇文章說明KOL的定義、優勢及其和網紅有哪些差異,並分享4個挑選合作KOL的原則,文末再推薦專業的小紅書跨境營銷代理商,幫你快速媒合KOL人選!

小紅書推廣全攻略|學會這些小紅書營銷秘訣,超高流量不是夢!

October 9, 2025

想用小紅書營銷打入年輕市場嗎?本文將介紹6大小紅書經營策略,教你怎麼利用小紅書宣傳自己的品牌,並解析廣告投放、網紅合作等宣傳方式,最後分享優質的一站式小紅書推廣服務廠商給你!

Xiaohongshu (Little Red Book) Marketing: Complete Guide

October 8, 2025

Learn how to market on Xiaohongshu, China’s rising social commerce platform. Connect with Chinese consumers, build trust, and grow your brand effectively.

Travel Retail Marketing: Winning Strategies for Chinese Consumers

October 8, 2025

Unlock growth with smart travel retail marketing. See how to attract Chinese travelers using data-driven insights and digital tools to drive sales and loyalty.

Kid Skincare in China: Trends and Strategies for a Growing Market

September 23, 2025

Discover the growing demand for kid skincare in the China Skincare Market. Learn about key trends and data-driven marketing strategy to engage parents in this rising segment with iClick.