We use cookies to give you the best digital experience. By continuing to browse this site, you give consent for cookies to be used. To learn more information about the use of cookies, please visit our cookie policy.

iSuite Insight Issue #22: Tapping into the Rebound of China’s Outbound Travel Market: Trends and Insights in 2025

In 2025, the outbound travel market from China is experiencing a rebound and transformation. Chinese travelers are increasingly stepping back into the global arena, with renewed appetite, evolving motivations and higher expectations. While digital, social and community behaviors are shifting, brands and marketers may rethink their strategies to tap into this powerful segment. Among these, the social-platform ecosystem led by Xiaohongshu (RedNotes) stands out as a core platform from inspiration to planning to sharing.

Leveraging iFans, iClick’s Xiaohongshu analytics platform, this article offers a clearer view of how Chinese travelers in 2025 think, behave and engage with user’s behavioral and engagement data. This issue of iSuite Insights wraps up the primary trends in China outbound travel this year: what the market size looks like, what travelers care about, how content is consumed, where attention is heading, and translate that into actionable take-aways for your brand strategies.

Overview of China’s Outbound Travel Market

Key Market Statistics

China’s role as a global outbound travel powerhouse is again asserting its scale and momentum. According to recent forecasts, the China outbound tourism market accounted for around USD 140 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of about 13.5% through 2025–2033, reaching approximately USD 386 billion by 20331.

The optimism for 2025 is high: a survey from the ITB China Buyer Circle reports that 74% of travel agents anticipate their outbound business for the year will exceed that achieved in 20242. Furthermore, Tourism Economics estimates that Chinese visitors to global destinations spent considerably more on a per-night basis in 2024 than those from other large source markets, continuing the pattern observed prior to the pandemic2.

This is clear and compelling: the size of the opportunity remains large, and the growth path is steep. Chinese outbound travel is growing, and digital engagement is rising in importance.

Insights from iSuite: Understanding 2025 Chinese Travelers

Audience Demographic

Based on iFans data in 2025, the total travel-related engagement stands at 2.2 billion. This large volume provides a strong foundation to interpret audience segmentation:

-

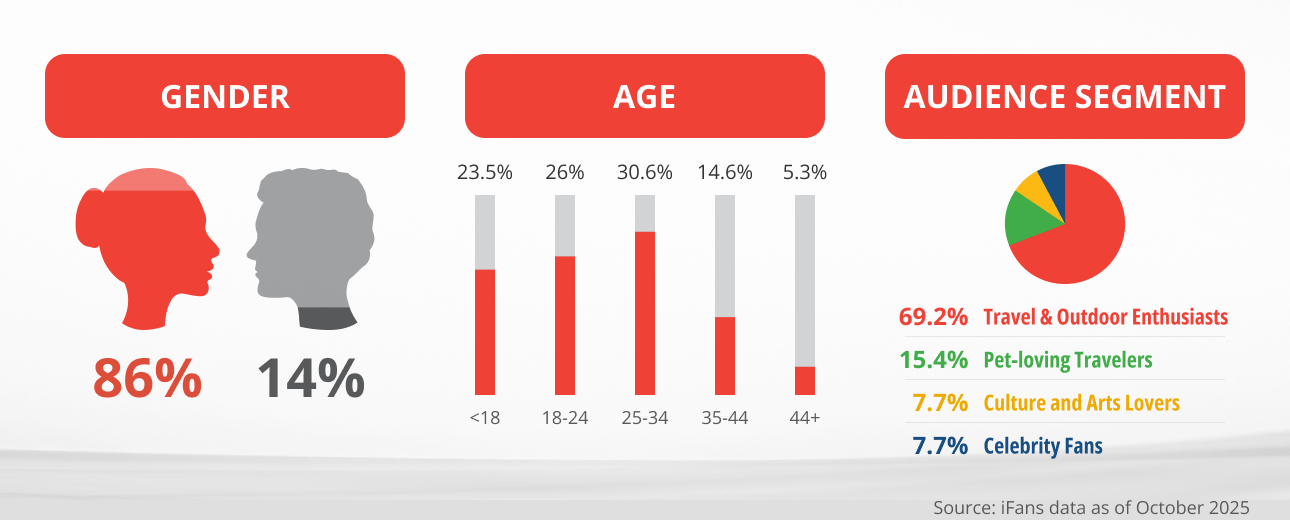

- Gender: 14% Male: 86% Female

-

- Age group:

- <18: 23.5%

- 18-24: 26.0%

- 25-34: 30.6%

- 35-44: 14.6%

- >44: 5.3%

- Age group:

-

- Audience Segment:

- Travel and outdoor enthusiasts: 69.2%

- Pet-loving travelers: 15.4%

- Culture and arts lovers: 7.7%

- Celebrity fans: 7.7%

- Audience Segment:

iFans data reveals that Xiaohongshu users engaging with travel content in 2025 are predominantly female (86%), with only 14% male. The community is also youth-driven, with 23.5% under 18, 26% aged 18–24, and 30.6% aged 25–34. This means over three-quarters are under 35, underscoring the role of Gen Z and Gen Alpha Chinese consumers and young millennials in driving the trend. The 35–44 group accounts for 14.6%, while 5.3% are over 44, representing a smaller but growing segment of mature travelers.

Within this community, travel and outdoor enthusiasts dominate at 69.2%, followed by pet lovers (15.4%), culture and art lovers (7.7%), and celebrity fans (7.7%). Together, these segments highlight how travel is increasingly intertwined with lifestyle, emotion, and personal identity. Young female users in particular are turning travel into a form of self-expression and storytelling, sharing aesthetic visuals, heartfelt reflections, and curated itineraries. This blend of aspirational discovery and authentic sharing underscores a new travel mindset — one centered on creativity, individuality, and emotional connection rather than purely sightseeing.

Trending Note Types on Xiaohongshu

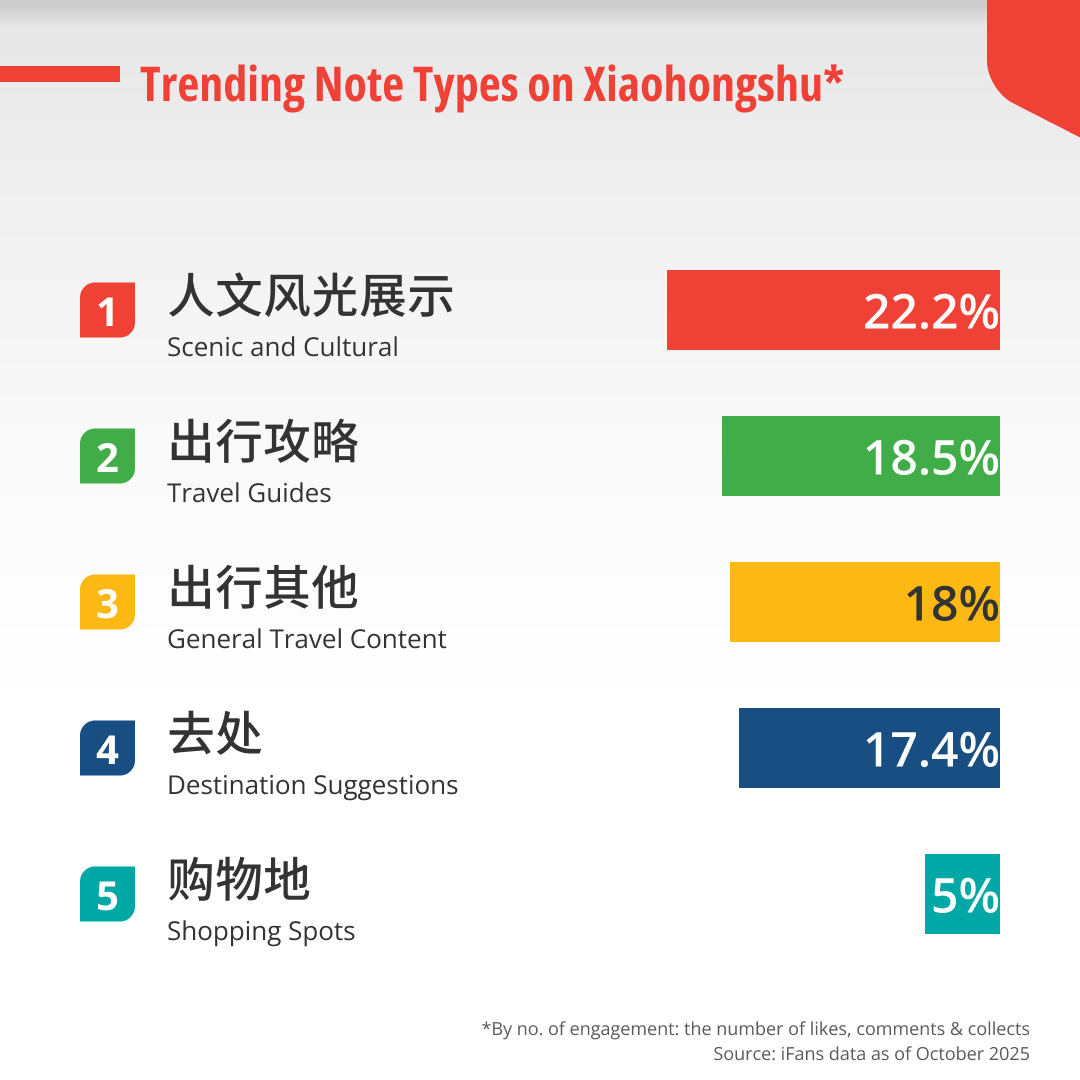

Our analysis of trending note types for travel in 2025 shows the following distribution of trending note type categories:

-

- The largest category is scenic and cultural (22.0%) tells us that Chinese travelers are heavily consuming visually rich, emotionally resonant content that emphasizes scenery and culture. These posts often serve as aspirational triggers, raising readers’ interests to a certain destinations or stores.

-

- Guides (18.5%) and destination suggestions (17.4%) also remain a very strong share, showing travelers want practical advice and fresh ideas on where to go, how to plan, what to expect — especially for longer-haul or more complex trips.

-

- General travel content (18.0%) includes travel diaries, lifestyle, transportation and food sharing. These posts show authentic “living the travel moment” side of the experience.

When curating travel-related content, lead with scenic storytelling and immersive visuals, and add elements of lifestyle or suggestions including destinations ideas, personal experiences and moments, may help to draw audience’s attention on China social media platform.

Engagement refers to the number of likes, comments & collects

Top 5 Hashtags by Engagement on Xiaohongshu

-

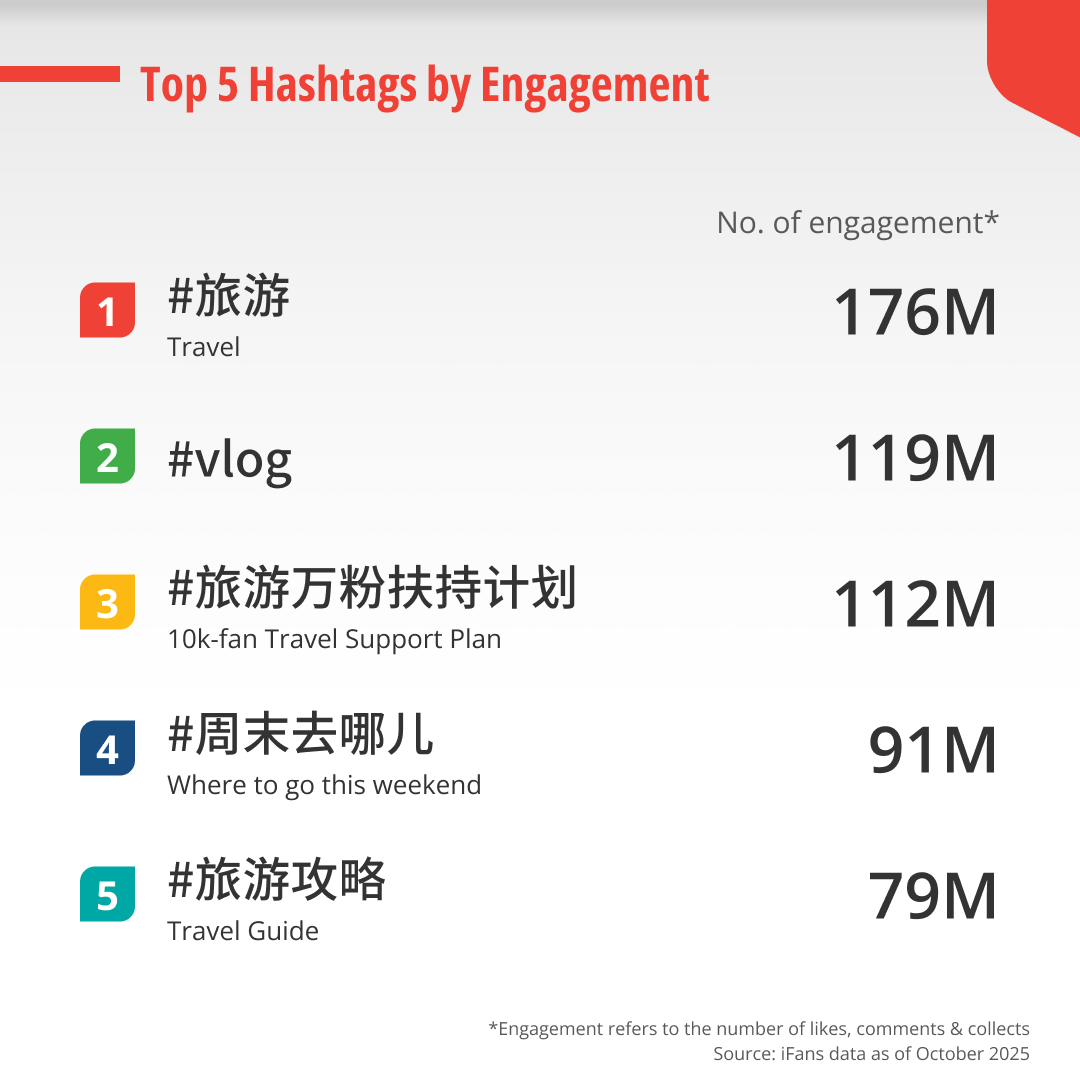

- Majority of the hashtags are broad, generic travel tags (#旅游, #vlog, #旅游攻略), reflecting high volume of user-generated travel content and consumption.

-

- The presence of platform-promoted hashtags (#旅游万粉扶持计划, #周末去哪儿) indicates that the Xiaohongshu algorithm brings more exposure using platform-encouraged hashtags.

For planning campaign, aligning with both generic travel and platform-promoted hashtags to reach broad travel audiences while tapping platform mechanics. Also, the prominence of “vlog” suggests short-form video or video-style content remains highly effective. Brands should lean into video-format notes on Xiaohongshu.

Chinese Outbound Travelers’ Preferences and Brand Performance

Most Popular Outbound Travel Destinations for Chinese Outbound Travelers

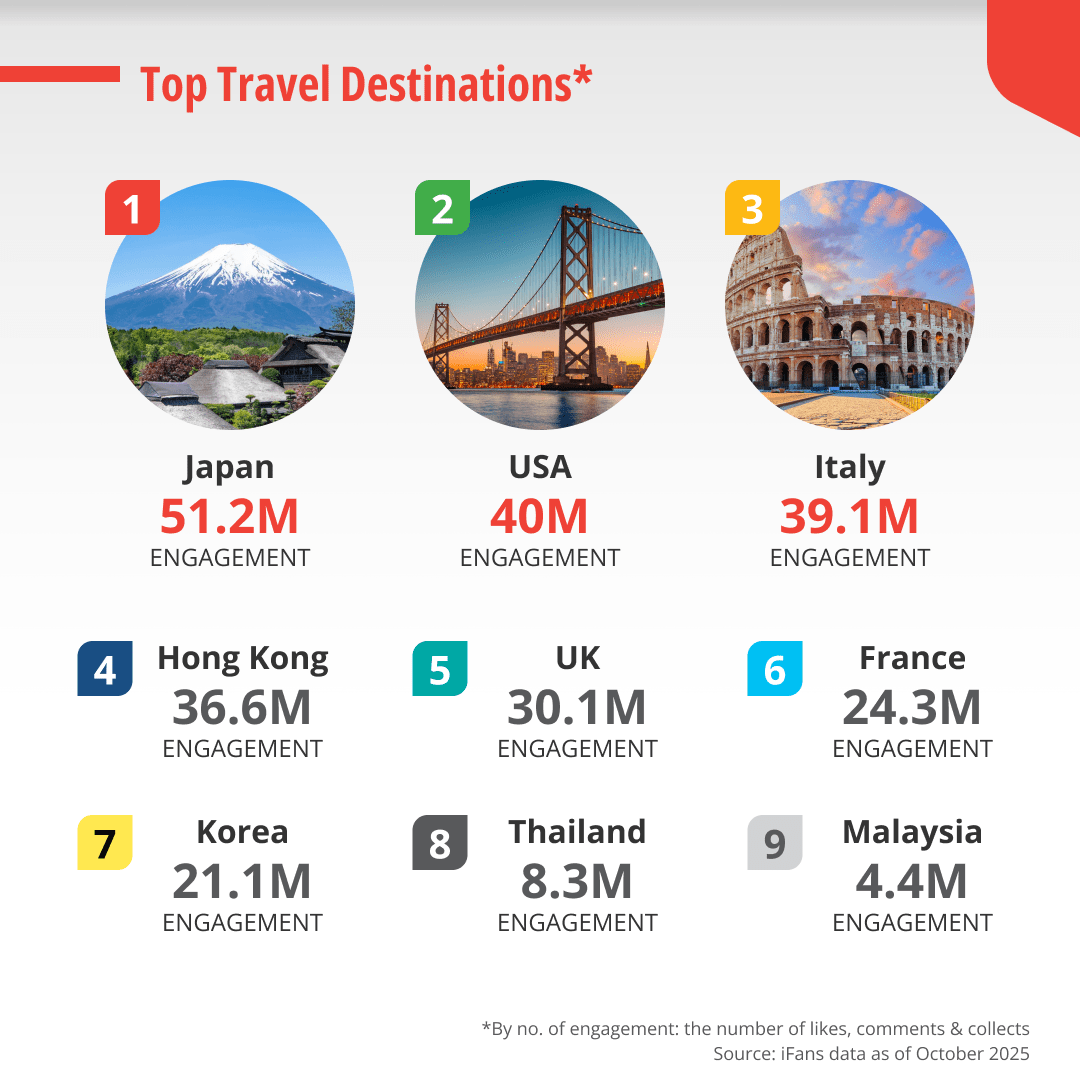

Analysis of the most popular outbound travel destinations by engagement on Xiaohongshu shows that virality of both short-haul and long-haul destinations:

-

- Japan, Hong Kong and Korea remain the top outbound markets for Chinese travelers, benefit from its proximity, strong seasonal appeal and cultural affinity for Chinese travelers.

-

- Thailand and Malaysia, with their visa-easier and travel-friendly policies, underscoring Southeast Asia's enduring appeal.

-

- The strong presence of long-haul destinations (USA, Italy, UK, France) in the top 10 show a meaningful shift: Chinese travelers are not only exploring nearby, but also showing increasing interest in Europe and North America.

Engagement levels for those destinations are almost as high as established regional favorites. As long-haul trips often require more planning, higher budgets and carry aspirational value, it drives higher engagement for users researching, blogging and sharing.

- The strong presence of long-haul destinations (USA, Italy, UK, France) in the top 10 show a meaningful shift: Chinese travelers are not only exploring nearby, but also showing increasing interest in Europe and North America.

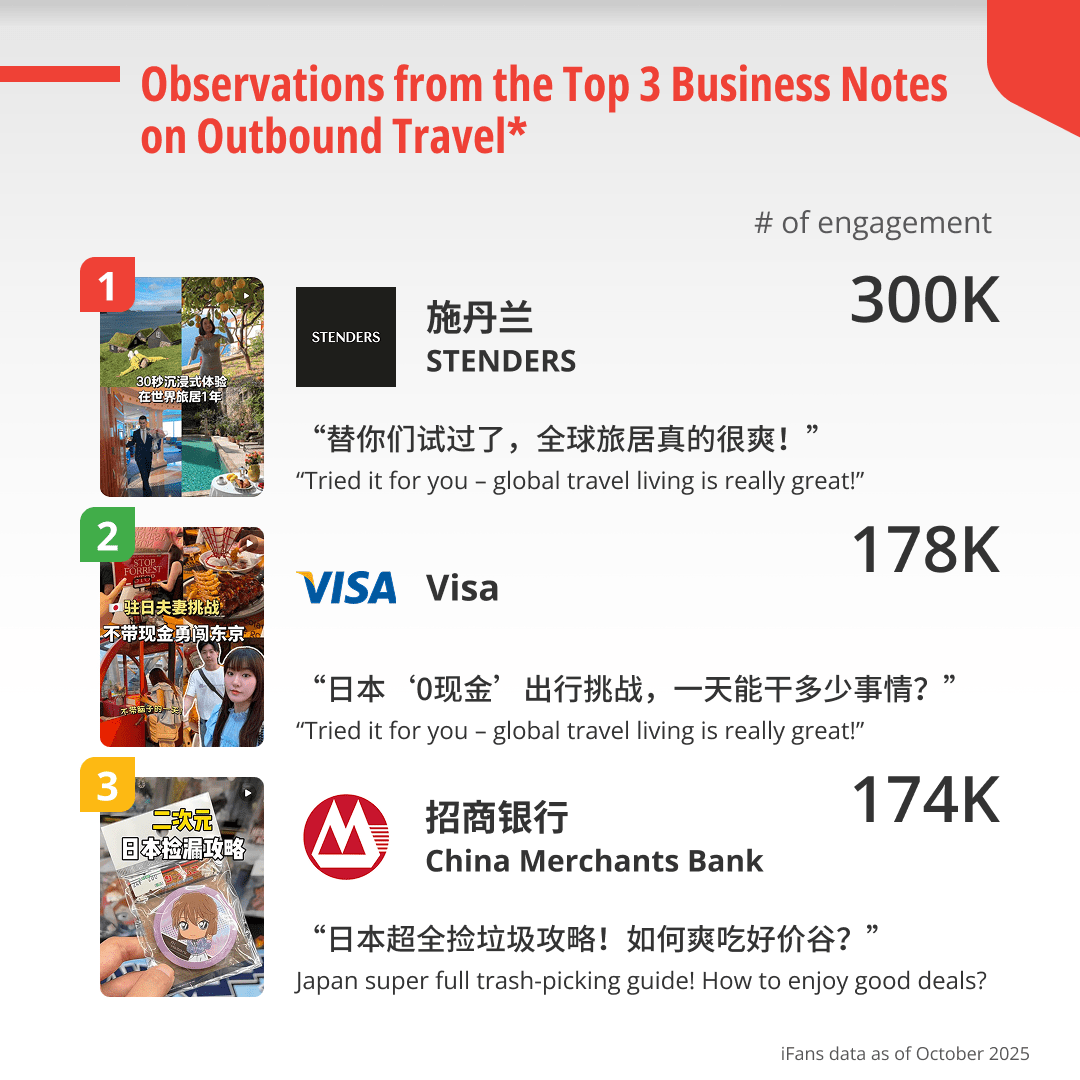

Observations from the Top 3 Business Notes on Outbound Travel

-

- Stenders: The top post, collaborating with the skincare brand Stenders, links travel with lifestyle and self-care, suggesting travel is not just going somewhere, it’s part of becoming “better you”. This emotional, aspirational framing performs well on the platform.

-

- Visa: Using a challenge format, the post from Visa is more fun, shareable, practical. Challenges resonate especially well in social platforms because they invite participation, curiosity and user mimicry.

-

- China Merchants Bank: This post shows offering strong utility (“full guide”, “deal hunting”) usually has a high engagement in travel contents.

In all three notes, the brands are not from the travel segment but skincare, payment and banking, yet they successfully integrate into travel narratives. This shows that cross-category brand involvement (beauty × travel / finance × mobility) can work if combining with authenticity and relevance.

Social Opinion Snapshots

China outbound travelers sentiment on Xiaohongshu is largely positive:

-

- 94% are positive user sentiment

-

- 6% are negative feedback

The overwhelmingly positive sentiment (94%), and keywords such as surprise, romance, discovery, suggest that travel is emotionally loaded. Chinese outbound travelers love sharing and celebrating experiences. Negative sentiment is far smaller but still important: it tends to focus on behavioral friction such as etiquette of travelers, service quality, respectfulness. It indicates Chinese travelers emphasize experience-quality: the service, friendliness of the trip can affect user perception and word-of-mouth.

To conclude, encouraging storytelling that leans into delight, novelty and authenticity, while reducing friction (clear expectations, respectful framing) helps brands stay aligned with the positive mood.

Key Takeaways for China Outbound Travel Market in 2025

1. Strong Rebound

China’s outbound travel market continues its robust recovery in 2025, with increasing trip volumes and spending, fueled by renewed consumer confidence after COVID-19 era.

2. Experience-Driven Travelers

Scenic showcases and practical travel guides dominate Xiaohongshu, showing travelers’ growing preference for authentic, emotional, and informative sharing content.

3. Cross-Category Opportunities

Brands from beauty to finance successfully tap into travel narratives through lifestyle storytelling, fun challenges, and destination-themed campaigns, indicating the golden opportunities for brands to tap into the market.

Conclusion:

China’s outbound travel market in 2025 signals a new era of experience-led tourism, where emotional storytelling and authentic digital engagement define success. As Xiaohongshu shapes every step of the traveler journey—from inspiration to sharing—brands that craft visually compelling, culturally resonant, and value-driven content will win the hearts of Chinese travelers worldwide.

Looking ahead to 2026, beyond this recovery phase, the long-term outlook is robust, with Chinese arrivals worldwide forecast to outpace that of other source markets from later in the decade.

Ready to Maximize Your Outbound Travel Strategy?

Contact iClick Interactive to turn data insights into market share in 2026.

Source:

1: https://www.marketresearch.com/DPI-Research-Marketing-Solutions-v4091/China-Outbound-Tourism-Forecast-42475185/2: ITB China Travel Trends Report 2025/2026 (Landing: https://www.itb.com/en/ITB-360%C2%B0/News-Insights/New-ITB-China-Travel-Trends-Report-2025-26-reveals-what-drives-China%E2%80%99s-travel-market.html)

Explore More iSuite Research

-

- China’s Booming Collectible Toy Market 2025

China toys market is booming, with collectible toys driving growth. Discover Chinese toy trends on Xiaohongshu with iClick to gain valuable insights.

- China’s Booming Collectible Toy Market 2025

-

- Unlocking China's Booming Health Supplement Market — Trends and Strategies for 2025

Unlock the potential of China’s health supplement market in 2025. Discover consumer trends, Xiaohongshu strategies, and tips for engaging Chinese audiences with vitamins, TCM herbs, and beauty supplements.

- Unlocking China's Booming Health Supplement Market — Trends and Strategies for 2025

-

- The Resilience of China’s Luxury Jewelry Market in 2025

Discover how Gen Z preferences, online trends, and cultural nuances are shaping China's luxury jewelry market and its future growth, and how your brand can capitalize.

- The Resilience of China’s Luxury Jewelry Market in 2025

More Insights

KOL等於網紅嗎?合作對象怎麼挑?搞懂KOL行銷就看這一篇!

November 19, 2025

KOL是什麼?和網紅有什麼分別?本文首先說明KOL是什麼意思、4大KOL構成要素,接著用表格分析KOL與網紅的差異,再分享挑選合作KOL時要注意的4大要點,最後推薦優質的小紅書行銷公司給你!

小紅書推廣全攻略|學會這些小紅書營銷秘訣,超高流量不是夢!

November 19, 2025

小紅書推廣經營策略有哪些?本文先說明用小紅書營銷宣傳的3大優勢,接著分享6大小紅書經營策略,幫助你輕鬆打造爆款內容,再介紹小紅書網紅合作等營銷方法,最後推薦一站式小紅書推廣服務商給你!

10 Top China Social Media Platforms 2025 & How to Market on Them

November 19, 2025

See China’s top social media platforms and learn essential marketing tactics, platform strengths, and consumer insights to win in the China digital market.

What Is KOL Marketing? Drive Trust & Growth with Influencers

November 19, 2025

Learn what KOL marketing is and how brands use key opinion leaders to build trust, enhance credibility, and drive engagement and conversions in China.

China Study Abroad Trends on Douyin: Bridging Global Education with Outbound Travel Discovery

November 12, 2025

Discover how Douyin drives China study abroad trends, linking overseas education with outbound travel, cultural exploration, and global lifestyle insights.

Mapping China’s Financial Trends on Xiaohongshu: From Discovery to Decision

November 6, 2025

Explore how Xiaohongshu drives China financial trends with rising engagement in wealth management, investment, and financial education content, transforming discovery into decisions.

Double 11 Shopping Festival 2025: The Craze Continues with Simplified Discounts

October 27, 2025

Explore iFans insights for Double 11 Shopping Festival 2025. Discover how simplified promotions and China social media trends are reshaping the China eCommerce landscape.

Unboxing China’s Digital Trends: Xiaohongshu Leads the Double 11 Gadget Boom

October 21, 2025

Explore China Digital Trends during Double 11 on Xiaohongshu. Discover how digital gadget brands can tap native content and data-led strategies to boost sales together with iClick Interactive.

Douyin Unlocks Fall 2025 China Fashion Trends: Seasonal Insights to Win Double 11

October 15, 2025

Discover China fashion trends this fall on Douyin. Explore top style insights and learn how iClick helps brands win seasonal audiences and maximize sales during Double 11.