We use cookies to give you the best digital experience. By continuing to browse this site, you give consent for cookies to be used. To learn more information about the use of cookies, please visit our cookie policy.

iSuite Insight Spotlight Issue #20: Unlocking China's Booming Health Supplement Market — Trends and Strategies for 2025

China’s health supplement market is undergoing a remarkable transformation, influenced by both cultural traditions and modern wellness trends. The rise in health awareness—intensified by the COVID-19 pandemic—has led to a shift in consumer behavior toward preventive care. Chinese consumers are increasingly investing in health supplements to boost immunity and maintain overall well-being. Demand spans two key segments: Western health products such as vitamins and dietary supplements (VDS), and Traditional Chinese Medicine (TCM) products, rooted in centuries-old healing philosophies. This article delves into key market statistics, consumer behaviors, trending content on Xiaohongshu, and strategies for brands to effectively engage with this fast-evolving sector.

Overview of China’s Health Supplement – A Billion-Dollar Opportunity

Key Market Statistics

According to iiMedia Research, China’s health supplements market was valued at approximately RMB 328.2 billion in 2023 and is projected to grow to RMB 423.7 billion by 2027, reflecting a robust compound annual growth rate (CAGR) of about 6.5%. This growth reflects rising disposable incomes, urban lifestyles, and a cultural shift toward proactive health management. Key drivers include:

-

- Post-Pandemic Awareness: COVID-19 accelerated demand for immunity-boosting supplements.

-

- Cultural Roots: TCM products, like goji berries and ginseng, resonate with consumers’ trust in holistic healing.

-

- Western Appeal: Scientifically backed vitamins and collagen attract urban, tech-savvy buyers.

Sources: https://www.nhnexpo.com/News/View/1197#:~:text=According%20to%20data%20by%20iiMedia,Survey%20data%20shows%2072%25%20of

Insights from iSuite: Understanding Consumers in China’s Health Supplement Market

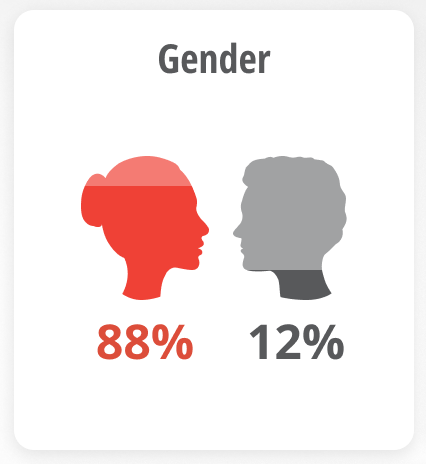

Audience Demographic

The health supplement market in China is predominantly driven by female consumers, with women accounting for 88% of the market compared to just 12% male. This gender skew reflects long-standing cultural roles, where women have traditionally acted as health guardians for their families—purchasing supplements for spouses, children, and elderly parents. However, a new trend is emerging: women are evolving from caretakers to proactive health advocates for themselves. Modern Chinese women are seeking ways to optimize their lifestyles, valuing holistic health. Supplements are increasingly viewed as an integral part of daily self-care, not just for addressing ailments, but for enhancing beauty, vitality, and resilience.

Source: iFans data as of April 2025

Trending Notes Style on Xiaohongshu

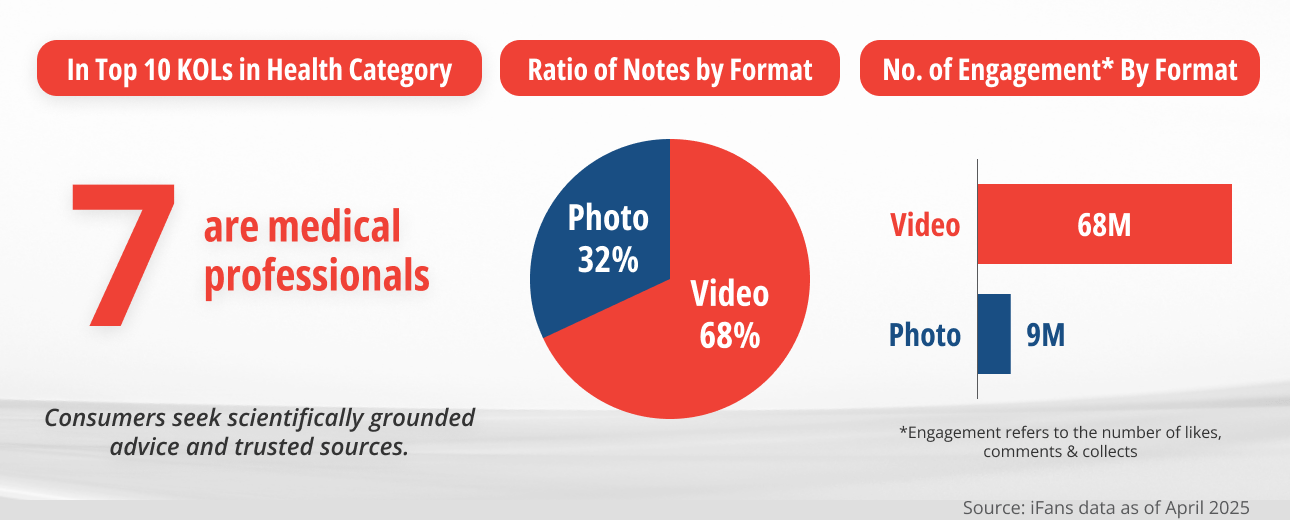

An analysis of the top performing Xiaohongshu notes related to health supplement reveals the following insights:

-

- Consumers Trust Professional Voices: An analysis of the top 10 Key Opinion Leaders (KOLs) in the health category on Xiaohongshu1 in April reveals a dominance of medical professionals—including practitioners of traditional Chinese medicine, dermatologists, psychiatrists, and general practitioners. This trend signifies a consumer preference for scientifically grounded advice and trusted sources. Brands that partner with authoritative figures can effectively enhance their credibility, as health-related tips and professional endorsements significantly boost both awareness and conversions.

1 Data by iFans index: This index evaluates an account’s performance on Xiaohongshu based on five key metrics: number of followers, follower growth, likes, saves, and comments.

- Consumers Trust Professional Voices: An analysis of the top 10 Key Opinion Leaders (KOLs) in the health category on Xiaohongshu1 in April reveals a dominance of medical professionals—including practitioners of traditional Chinese medicine, dermatologists, psychiatrists, and general practitioners. This trend signifies a consumer preference for scientifically grounded advice and trusted sources. Brands that partner with authoritative figures can effectively enhance their credibility, as health-related tips and professional endorsements significantly boost both awareness and conversions.

-

- Video Outperforms Photo: For health supplement content on Xiaohongshu, video content significantly surpasses photo posts in performance. This can be attributed to several reasons:

-

- Demonstration Value: Videos offer richer storytelling, allowing KOLs to effectively showcase product usage, illustrate transformations, and compare ingredients.

-

- Authenticity and Engagement: The dynamic combination of motion and voice creates a deeper emotional connection, enhancing the credibility and persuasiveness of health claims.

-

- Platform Optimization: Xiaohongshu’s algorithm favors video content within the health and wellness sector, as it generates higher dwell time and shareability, thereby improving visibility and driving organic reach.

For brands, leveraging video—especially short-form and vertically framed clips—is crucial in capturing audience attention and increasing content discoverability.

- Platform Optimization: Xiaohongshu’s algorithm favors video content within the health and wellness sector, as it generates higher dwell time and shareability, thereby improving visibility and driving organic reach.

-

- Video Outperforms Photo: For health supplement content on Xiaohongshu, video content significantly surpasses photo posts in performance. This can be attributed to several reasons:

Source: iFans data in April 2025

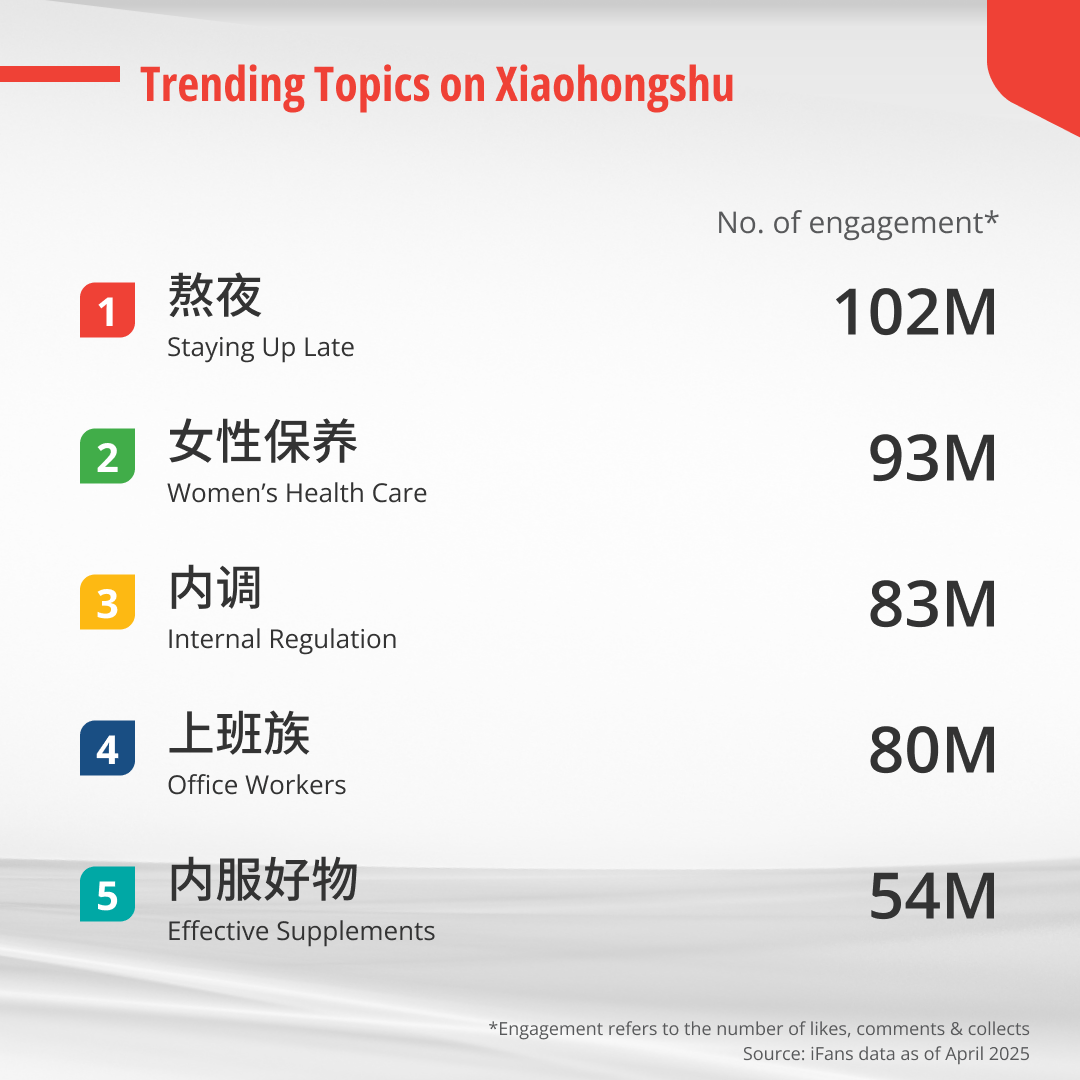

Trending Topics for Health Supplement on Xiaohongshu by Engagement

Trending keywords on Xiaohongshu reveal high engagement around health supplement topics that emphasize internal wellness and daily health challenges faced by younger Chinese consumers, especially working women:

-

- Engagement among Younger generations: Hashtags like “#熬夜” and “#上班族” reflects the interests of consumers with busy lifestyles actively searching for supplements to manage fatigue, skin concerns, and energy levels.

-

- Priority on Internal health: Tags like “#內調” and “#內服好物” emphasize a strong consumer belief in improving health from within, often inspired by TCM philosophies.

These trends indicate that supplements are increasingly perceived as essential components of daily self-care rather than occasional remedies—particularly among young, health-conscious women.

Source: iFans data as of April 2025

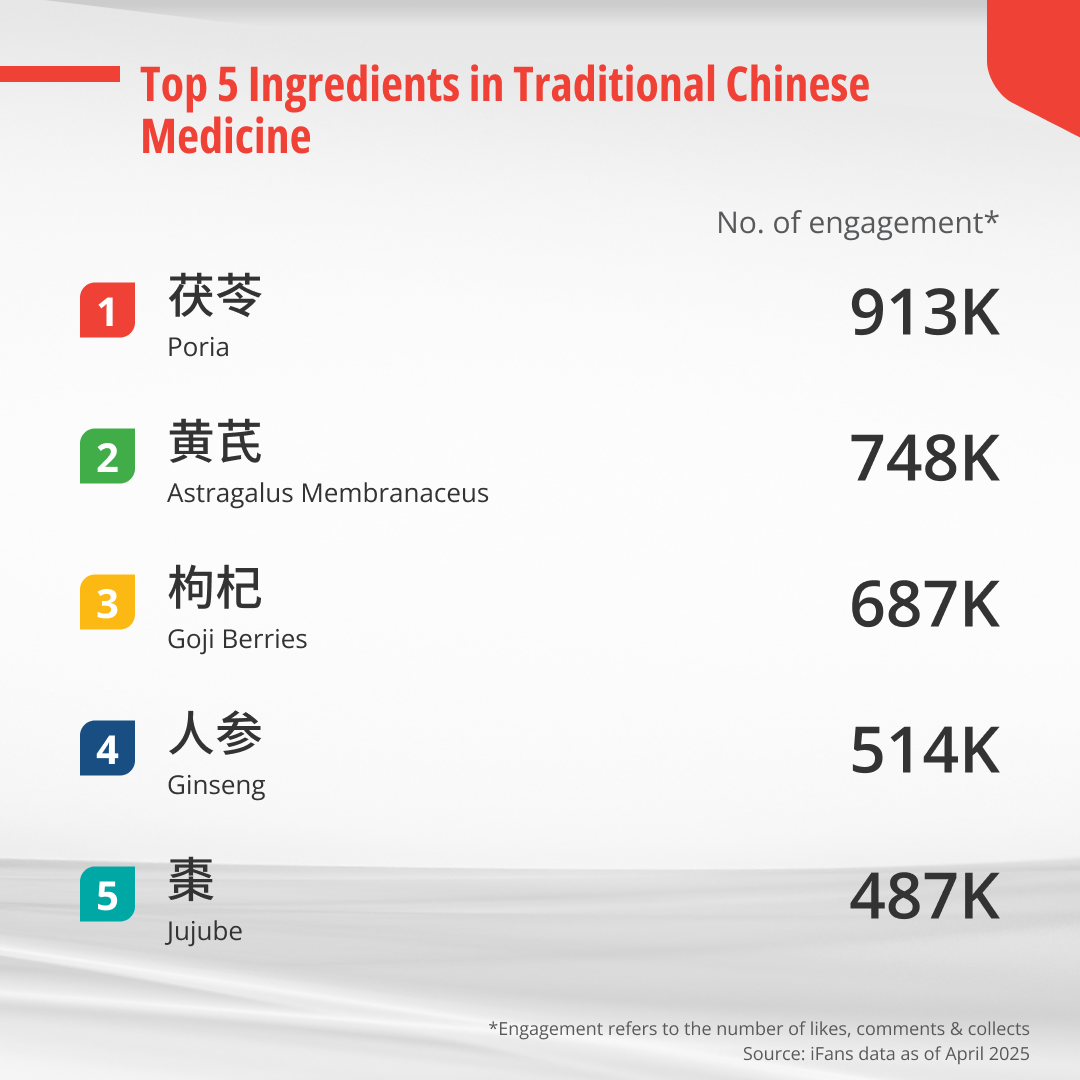

Top Engaged Ingredients in Traditional Chinese Medicine (TCM)

Chinese consumers’ deep-rooted trust in TCM has helped popularize herbal supplements that promise holistic benefits, such as strengthening immunity, combating aging, and improving energy levels. The following ingredients have emerged as the most engaged on Xiaohongshu:

-

- 茯苓 (Poria): 913K – Known for its calming, anti-inflammatory, and digestive health properties.

- 黄芪 (Astragalus membranaceus): 748K – Believed to boost immunity and alleviate fatigue.

- 枸杞 (Goji berries): 687K – Popular for promoting vision health, liver protection, and anti-aging.

- 人参 (Ginseng): 514K – A staple for vitality, immune support, and mental clarity.

- 棗 (Jujube): 487K – Associated with improved sleep, digestion, and blood circulation.

The rising popularity of TCM among younger generations signals a cultural revival, where traditional health practices are integrated into modern lifestyles. These herbs resonate with Chinese consumers due to generational familiarity, perceived safety, and a strong belief in preventive care.

Source: iFans data as of April 2025

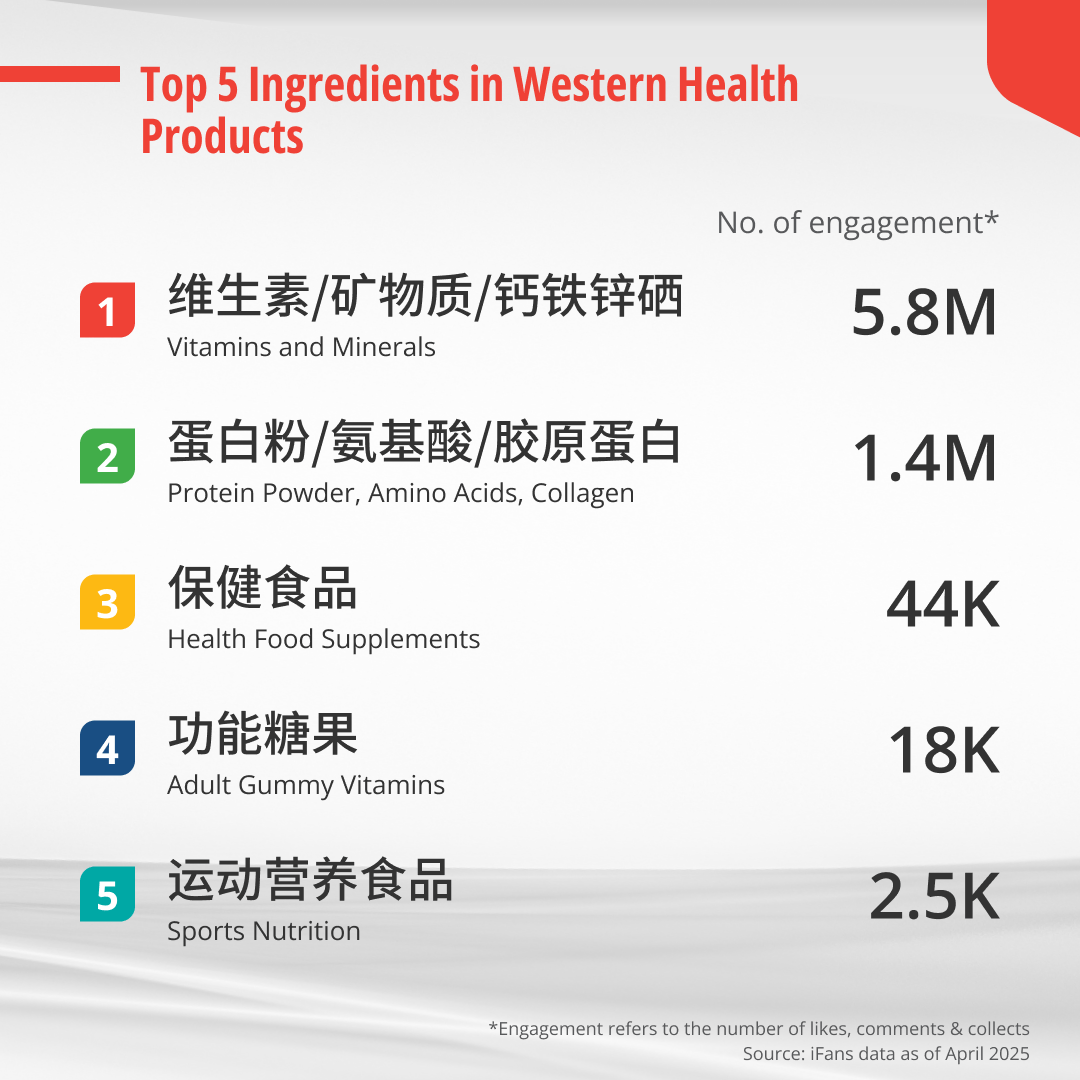

Top Engaged Ingredients in Western Health Products

Western-style health supplements also attract significant attention on Xiaohongshu, particularly those marketed with scientific backing, clinical studies, and international brand prestige. The most engaged Western ingredients in April include:

-

- 维生素/矿物质/钙铁锌硒 (Vitamins and Minerals): 5.8M – Essential for overall well-being, immune support, and bone health.

- 蛋白粉/氨基酸/胶原蛋白 (Protein Powder, Amino Acids, Collagen): 1.4M – Popular for their benefit in fitness, skin care, and muscle recovery.

- 保健食品 (Health Food Supplements): 44K – A broad category includes supplement food and drink such as probiotic and vegetable juice.

- 功能糖果 (Adult Gummy Vitamins): 18K – Appealing to younger consumers seeking

- 运动营养食品 (Sports Nutrition): 2.5K – Indicative of a growing fitness culture, especially in urban areas.

Western products appeal to Chinese consumers because of their precise formulation, scientific branding, and global credibility. Additionally, the convenience of capsules, powders, and gummies aligns well with the fast-paced lifestyles of young urbanites.

Source: iFans data as of April 2025

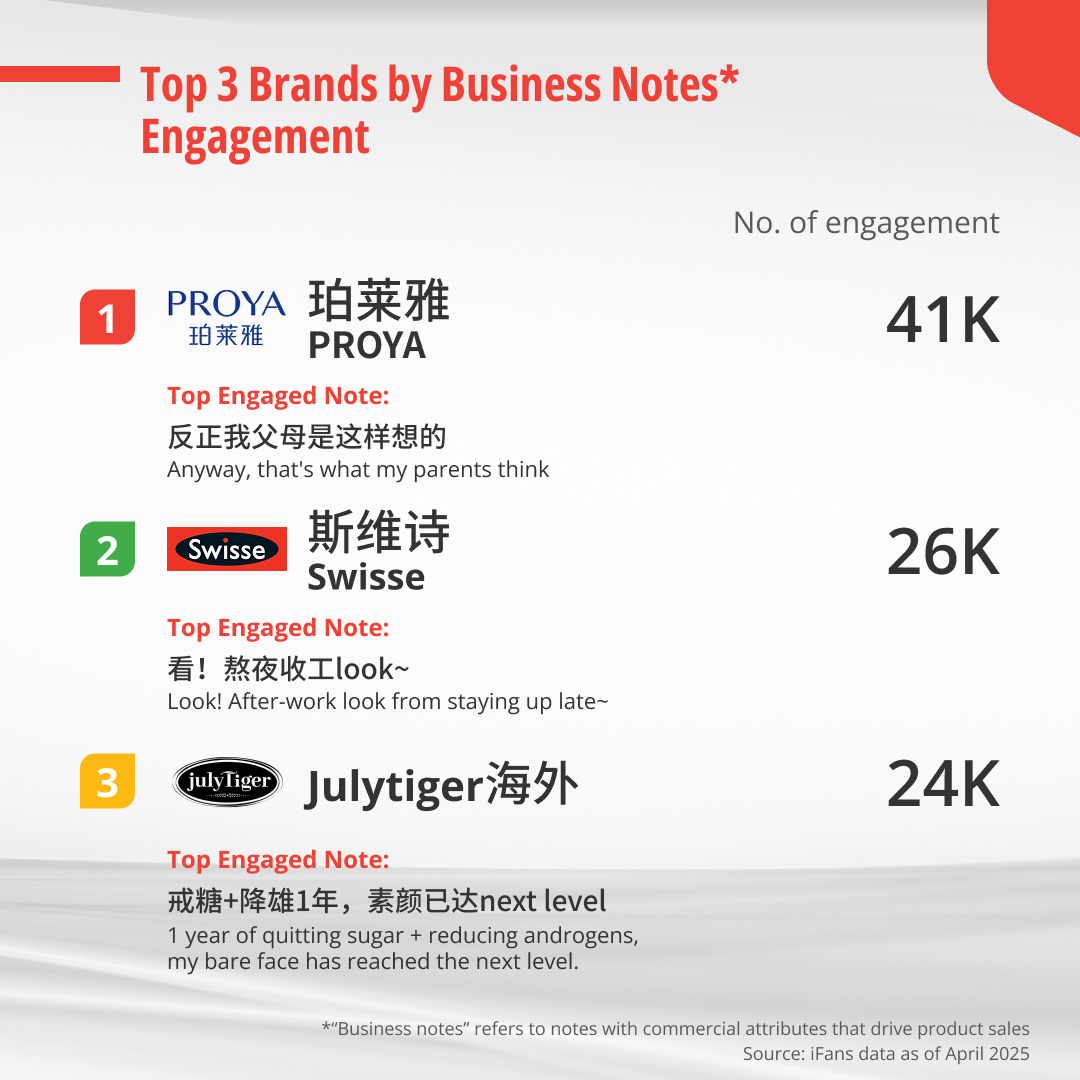

Brand Performance and Consumer Preferences on Health Supplement

Observations from the Top 3 Brands by Business Notes’ Engagement

Consumer behavior on Xiaohongshu shows that Chinese audiences are drawn to content that not only promotes products but also educates and inspires. Insights from the top-performing posts of health supplement brands reveal two major strategies that resonate strongly with consumers.

-

- Focus on “A Better Self”: Leading brands emphasize the concept of becoming a better version of oneself through consistent supplement use: For instance, PROYA highlights how daily supplementation can lead to noticeable improvements in skin and body condition, while also empowering women by linking wellness with self-worth and personal growth.

-

- Sharing Personal Experiences: Brands like Swisseand Julytiger adopt an educational approach, sharing practical tips on maintaining healthy skin through regular supplement use. They often break down the benefits of specific ingredients, enhancing consumer understanding and trust. This combination of aspirational messaging and informative content is key for building credibility and emotional resonance in a competitive and personal category.

Source: iFans data as of April 2025

Conclusion on China’s Health Supplement Market

The health supplement market in China is evolving rapidly, driven by heightened post-pandemic health awareness, female empowerment, and digital culture. From Traditional Chinese Medicine to Western supplement, consumers are increasingly proactive in managing their health and appearance, and actively seeking for professional advice, product news and lifestyle tips.

Key Takeaways for Brands:

-

- Emotional Connection Matters: Align product benefits with broader themes like beauty, empowerment, or self-care to create deeper resonance with consumers.

-

- Informative Content Wins: Offer useful tips, ingredient breakdowns, and real-life applications to gain trust.

-

- Influencer Partnerships with Purpose: Collaborate with both medical experts and relatable micro-influencers to cover a wide spectrum of consumer trust points.

Brands looking to succeed in this market must adopt a culturally nuanced and digitally agile approach. Leveraging video content, professional KOL endorsements, and authentic storytelling can unlock new opportunities. As health becomes a lifestyle choice rather than a mere necessity, the potential for health supplements is enormous.

Ready to explore in-depth strategies tailored to your brand? Contact our iClick team today for a personalized consultation.

Previous iSuite Insights stories:

More Insights

She Economy in China: Redefining Identity Through Consumption this 3.8 International Women’s Day 2026

March 3, 2026

Discover how She Economy is reshaping China’s consumption landscape. From digital behaviors to travel and lifestyle upgrades, explore what brands must do to win China women consumers with iClick.

China Social Media 2026: Popular Platforms & Winning Strategies

February 24, 2026

Explore China’s most-used social media platforms and learn key marketing tactics, platform strengths, and consumer insights to succeed in the digital market.

KOL Marketing Guide: Strategies to Grow with Influencers in China

February 24, 2026

Discover how KOL marketing helps brands reach Chinese consumers, strengthen credibility, and increase engagement through trusted influencer partnerships.

Interest-Led Journeys: How Cultural Travel Trends Are Shaping China’s Outbound Travel on Xiaohongshu

February 24, 2026

Explore how China outbound travel is reshaped by cultural travel on Xiaohongshu. Discover 2026 key trends, insights, and strategies for marketers with iClick.

From Festive Motifs to Cultural Immersion: How Luxury Brands Win China in 2026

February 11, 2026

Explore how luxury brands engage the Chinese luxury consumer in 2026 with cultural immersion and localized storytelling, boosting emotional connection and relevance through year-round engagement strategies.

Chinese Media Insight Spotlight #20 – March Media Updates

February 10, 2026

Discover March’s China media and platform updates, from Xiaohongshu search marketing, Tencent's CNY activation to Baidu’s AI assistant.

KOL等於網紅嗎?合作對象怎麼挑?搞懂KOL行銷就看這一篇!

February 5, 2026

KOL與網紅有何不同?本文從KOL是什麼開始,說明KOL的定義與構成要素,比較KOL和網紅的分別,整理品牌和KOL合作需留意的4大重點,文末推薦專業代理商,幫助品牌與小紅書KOL合作,輕鬆創造高聲量。

小紅書推廣全攻略|學會這些小紅書營銷秘訣,超高流量不是夢!

February 5, 2026

小紅書推廣如何快速出圈?本文將說明品牌在小紅書宣傳的好處,整理6招經營策略,深度解析廣告投放、網紅合作等多種營銷方式,並首推專業服務商「iClick」,幫助品牌掌握流量密碼,量身規劃爆款行銷方案。

iSuite Insight Issue #23: Decoding China’s Winter Skiing Phenomenon: Marketing Trends and Insights in 2026

February 5, 2026

Discover iClick insights on how skiing has become into China’s signature winter activity, from audience behavior to content insights, and how Xiaohongshu shapes winter ski inspiration and decision-making. Learn key engagement strategies for brands targeting the 1 trillion RMB market.