We use cookies to give you the best digital experience. By continuing to browse this site, you give consent for cookies to be used. To learn more information about the use of cookies, please visit our cookie policy.

iSuite Insights Spotlight - Issue #9 Understanding The Latest Online Behaviour Of Chinese Travelers

The Chinese Labor Day Holiday is an exciting time for the tourism market. The 2023 Labor Day Holiday is the first "Golden Week" holiday since lifting travel restrictions. It showcased a remarkable surge in outbound travel, with spending surpassing pre-pandemic levels. Data from Ctrip shows that overall outbound travel booking volume climbed by about 700% compared to the same period in the previous year, with outbound air ticket and hotel booking volume jumping by almost 900% and 450%, respectively, compared to the same period in 2022.

Based on iAudience and iFans data, we have traced and profiled Chinese netizens who actively followed Labor Day Holiday-related topics, highlighting their audience profiles, preferences, and online behaviors, providing valuable strategic insights for marketers targeting Chinese travelers.

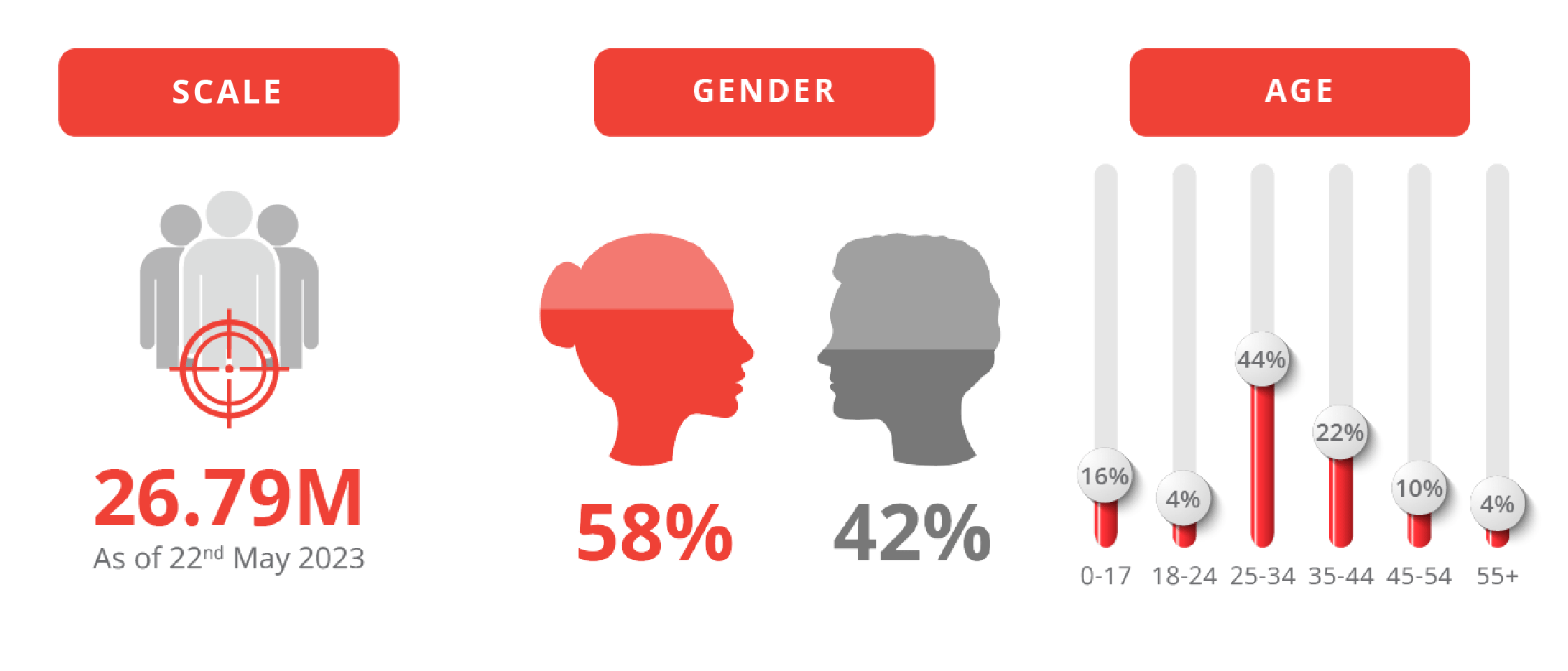

AUDIENCE DEMOGRAPHICS

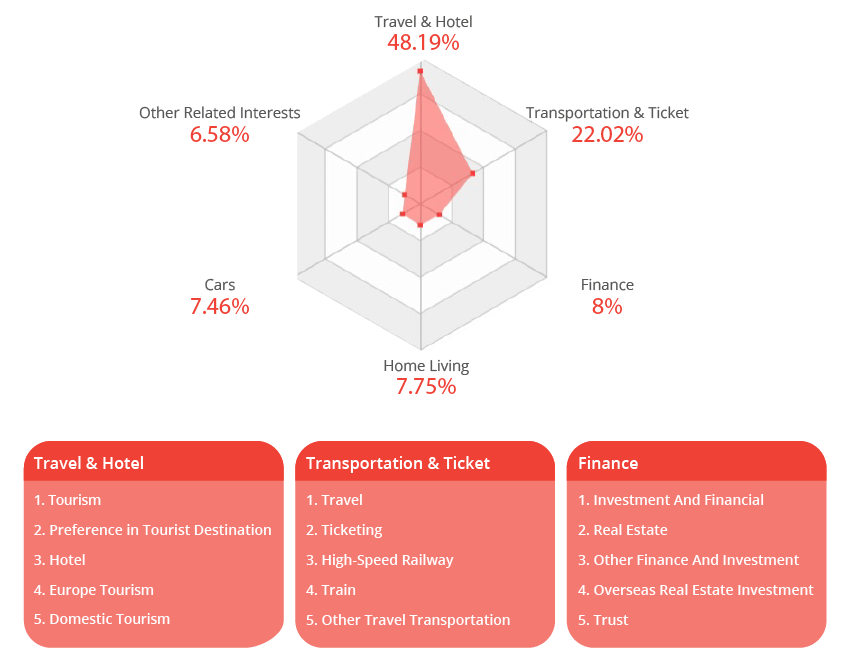

AUDIENCE INTERESTED CATEGORIES

- Audiences are interested in topics related to Travel & Hotel, Transportation & Ticket, and Finance.

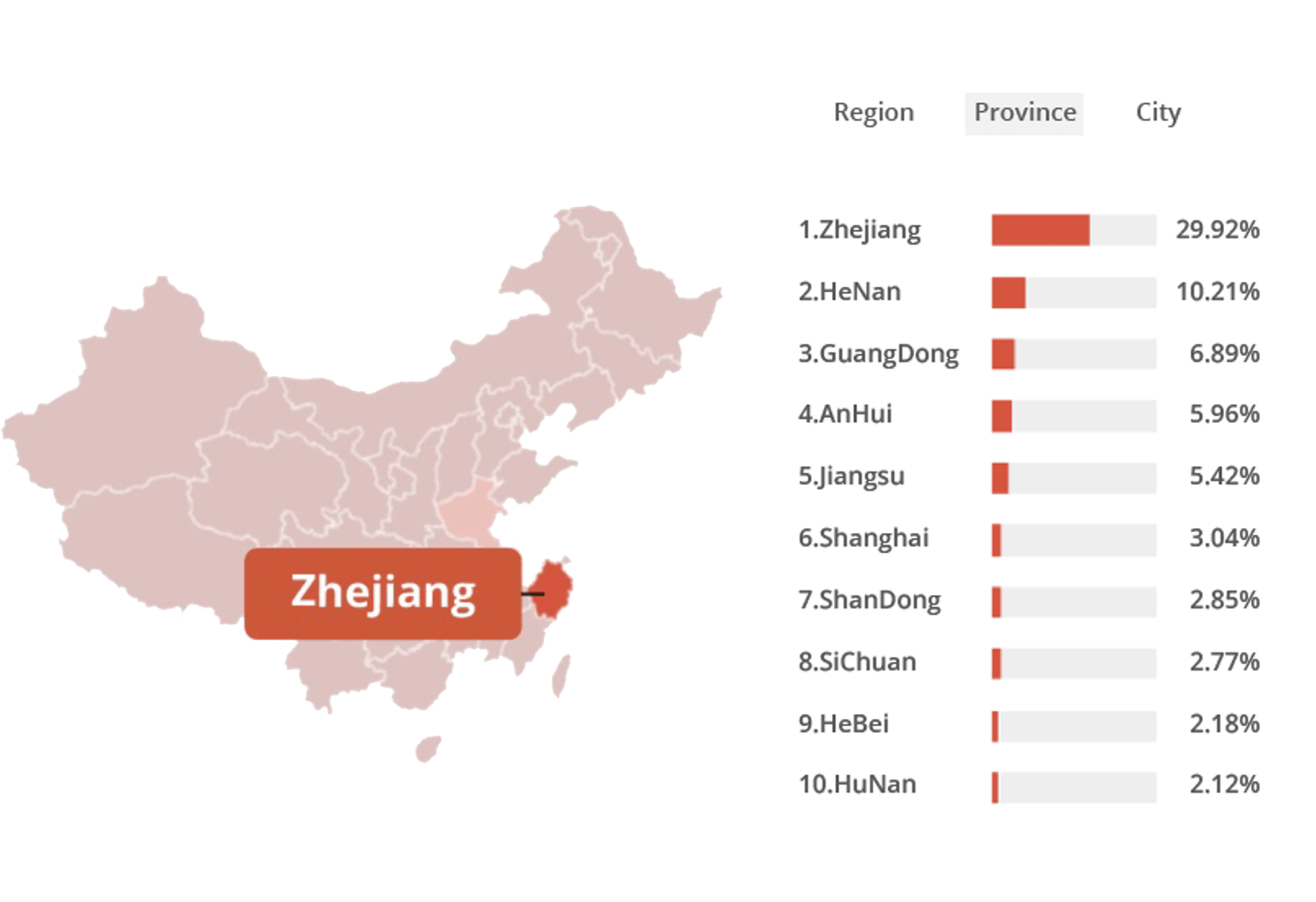

AUDIENCE GEOGRAPHIC LOCATIONS

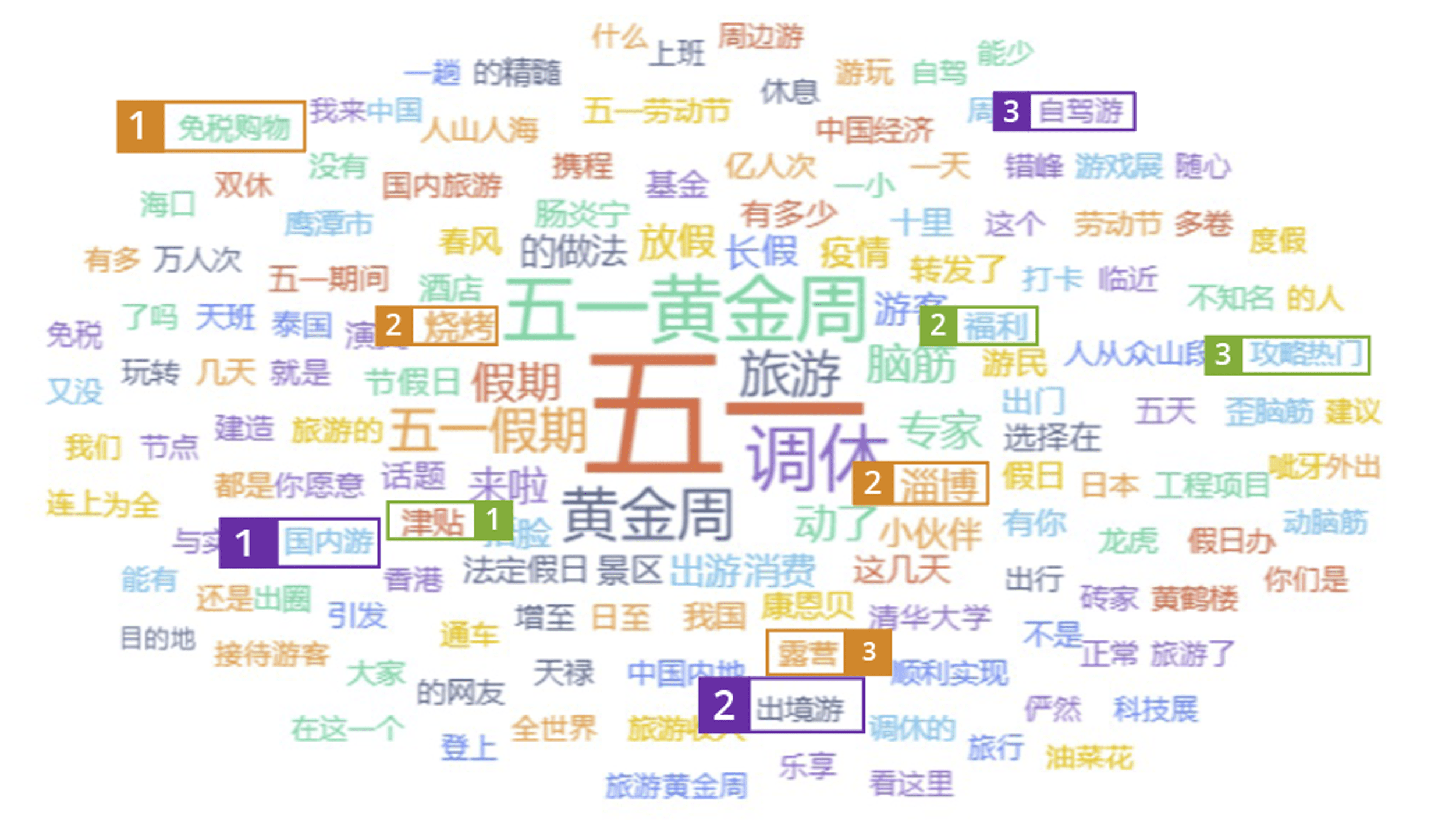

PUBLIC OPINION KEYWORDS

Travel Activities: Duty-free Shopping1, Zibo Barbecue2, Camping3

Travel Style: Domestic Travel1, Outbound Travel2, Road Trip3

Travel Information: Subsidy1, Welfare2, Guideline3

- Duty-free shopping, Zibo Barbeque, and Camping are popular travel activities among Chinese travelers.

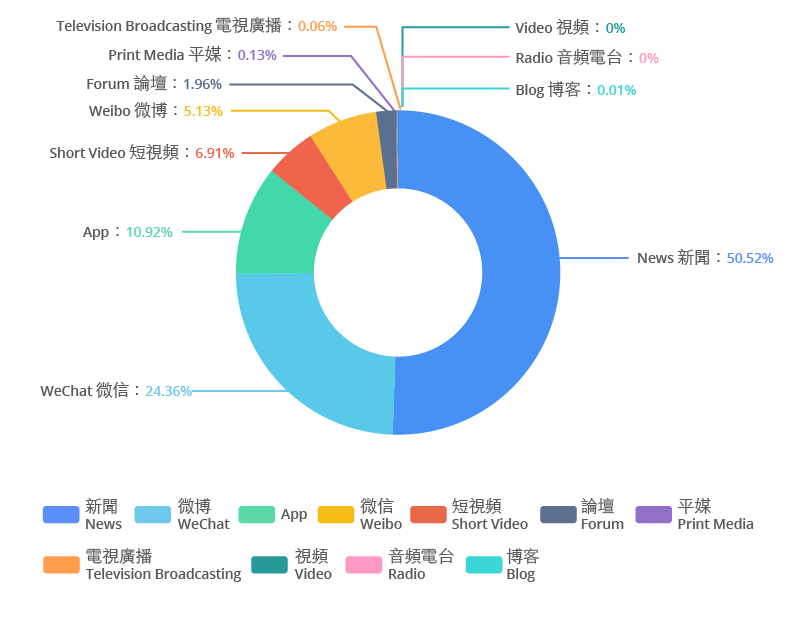

PUBLIC OPINION SOURCES

- Haikou, Zibo, Hong Kong, Thailand, and Japan are the top travel destinations during Chinese Labor Day.

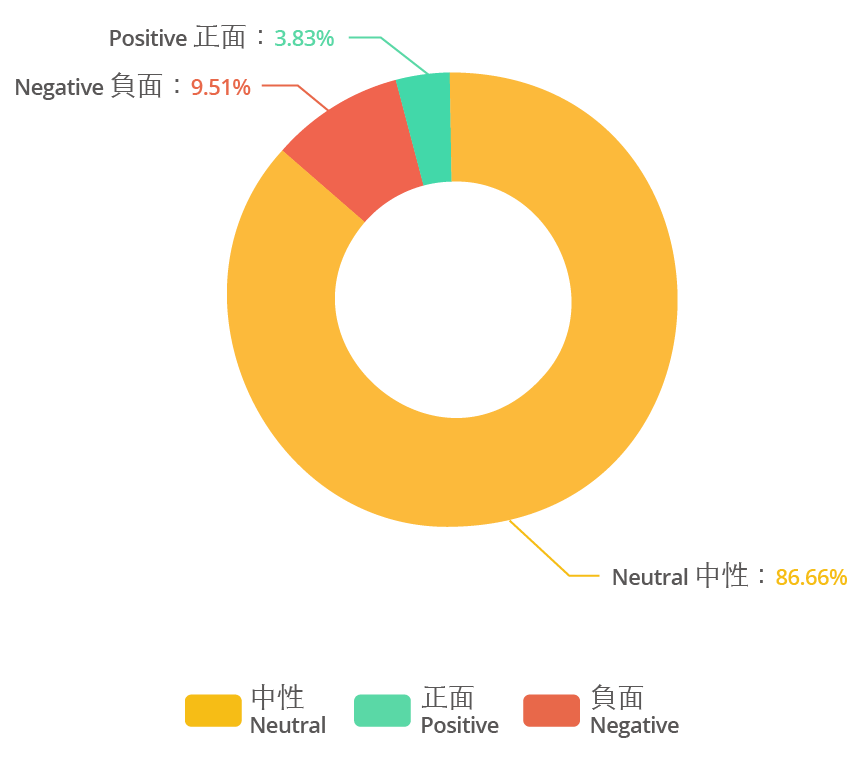

PUBLIC OPINION SENTIMENT TENDENCY

PUBLIC OPINION SNAPSHOTS

- Audiences actively debated and discussed the Special Holiday Arrangements of Chinese Labor Day.

More Insights

iSuite Insights Spotlight – Issue #16 Navigating China's Fast-Growing Maternity Product Market

July 24, 2024

The maternity product market in China is booming, with a projected growth from $31 billion in 2023 to $87 billion by 2032. Key factors driving this growth include an increasing number of working women and a rising interest in natural and organic pre- and postnatal care items. Insights from iSuite reveal trending topics and top product categories on Xiaohongshu, providing valuable information for businesses looking to capitalize on this fast-growing market.

China's Booming Mini-Program Ecosystems

July 12, 2024

Did you know that the largest mini-program ecosystem in China is actually within WeChat, the country's ubiquitous super app? But Alipay, the digital wallet app, has emerged as the #2 player - and it's growing fast!

iClick's Latest Report: Unlock the Digital Behaviors of Affluent New Hongkongers

July 10, 2024

iClick's latest report, "Engaging Affluent New Hongkongers: A 2024 Digital Media Report", unveils the digital behaviors and mindset of this influential segment. As more mainland Chinese make Hong Kong their new home, understanding their unique preferences is the key to unlocking your next big growth opportunity.

Xiaohongshu's First Platform-Level IP for New Product Success

July 8, 2024

Xiaohongshu (XHS) launched its first platform-level product marketing IP 「宝藏新品」("Treasure Trove") in May 2023, taking a holistic approach to supporting brands in successfully launching and growing new products on the platform

China's Outbound Tourism on the Rebound: What to Expect for 2024

May 23, 2024

In this newly released whitepaper, “2024 Chinese Outbound Travelers Whitepaper”, iClick collaborated with industry leaders such as Qunar and Ocean Engine, along with a market research firm, to provide comprehensive insights for brands and marketers. These insights provide a deeper understanding of China’s outbound travel sector and the latest consumption trends, empowering marketers to make strategic decisions.

iSuite Insights Spotlight – Issue #15 Chinese Consumer Behavior Towards Hotel During Golden Week

May 22, 2024

Chinese high-net-worth consumers are willing to spend on luxury hotels for high-quality hotel services. According to Statista, the Chinese hotel market is expected to reach USD 93.62Bn by 2024, growing at a CAGR of 4.72% from 2024 to 2028. To win over consumers in the market, most luxury hotel brands actively engage with audiences via rich brand content and visual stories to present the luxurious lifestyle on social media.

小紅書推廣全攻略|學會這些小紅書營銷秘訣,超高流量不是夢!

May 11, 2024

小紅書推廣怎麼做?小紅書營銷方式有哪些?本文將介紹6種小紅書經營策略,帶你一步步打造爆款內容!而廣告投放和小紅書網紅也是變現不可或缺的宣傳手段,就讓專業小紅書推廣服務商iClick,帶你了解小紅書的流量秘訣!

iSuite Insights Spotlight - Issue #14 Exploring China's Dynamic Sports And Fitness Market Trends

March 28, 2024

In the bustling landscape of China’s sports and fitness market, KOLs have become a significant force in driving consumer behavior and influencing purchasing decisions. Opportunities abound for brands seeking to capitalize on this trend. According to Statista, China’s sportswear market value reached USD 43.6 billion in 2023 and the estimated YoY growth of the Chinese sportswear market is 4.3% for 2024.

What is XiaoHongShu (Little Red Book) – iClick Interactive

February 19, 2024

Explore Xiaohongshu, the little red book, the revolutionary Chinese app blending social media and e-commerce, with over 200 million monthly active users.